Since Aug. 2015, China’s market price of MSG has recorded slumps mainly because of financial and inventory

pressure on manufacturers, dropping raw material price and markedly increasing

operating rate of manufacturers.

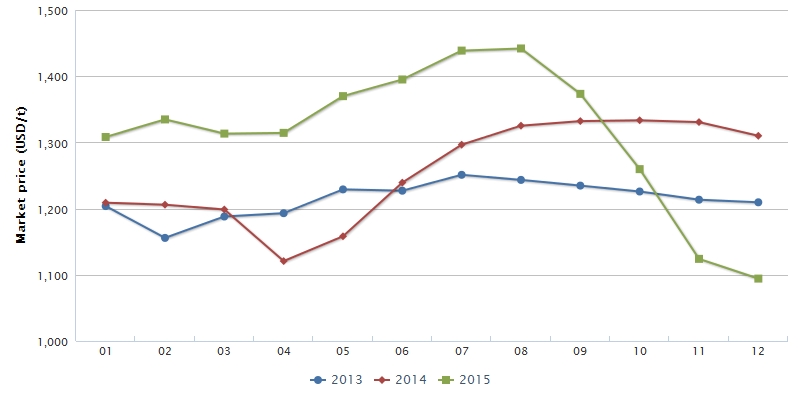

In H2 2015, China’s market price of MSG suffers large ups and downs, which hit

the highest of recent 3 years in Aug. Nevertheless, after 4 months, the price

hits a record low of recent 3 years. Frequent fluctuations in the price trouble

downstream purchasers. According to CCM research, the price started to rise in mid-April.

And then hit a record high of recent 3 years in Aug., being USD1,441.91/t

(RMB8,820/t). After that, the price dropped rapidly, being USD1,094.21/t

(RMB7,000/t) in Dec., down 24.11% compared to Aug.

China's market price of MSG (40 meshes) in Jan. 2013-Dec. 2015

Source: CCM

It is known that the declining market price is mainly ascribed to 3 factors.

1. Financial and inventory pressure

Since the price was too high before, downstream purchaser generally hold

wait-and-see attitude, resulting in limited actual transaction volume. As the

inventory increases, manufacturers tentatively reduce the price to ensure the

normal turnover of capital and inventory.

2. Dropping price of raw material

Currently, China’s market price of corn (raw material of MSG) is significantly

lower than that of last year. MSG manufacturers enjoy large profit space.

In Dec. 2015, China’s market price of corn is USD297/t (RMB1,900/t), down

19.07% year on year, sourced from CCM. Based on the cost scheme, producing one

tonne of MSG needs the costs of 2.5 tonnes of corn, 2.5 tonnes of coal, 0.4

tonne of liquid ammonia and 0.5 tonne of sulfuric acid as well as USD93.79

(RMB600) of incidental expenses, the average profit of MSG manufacturers is

about USD78.16/t (RMB500/t) in Dec. While the profit was USD250.11/t

(RMB1,600/t) in Aug. With huge profit margin, manufacturers have more room to

reduce the price when facing inventory pressure.

3. Obviously increasing operating rate

Although China’s MSG market is dominated by Meihua Holdings Group Co., Ltd.,

Fufeng Group Co., Ltd. and Ningxia EPPEN Biotech Co., Ltd., the market

competition is increasingly fierce because more and more manufacturers resume

production attracted by the high profit margin. The operating rate of the

industry is rising generally.

Daily output and operating rate of China's

major MSG producers on 14-18 Dec., 2015

|

Enterprise

|

Daily output, tonne

|

Operating rate

|

|

Tongliao Meihua Bio-Tech Co., Ltd.

|

1,150

|

87%

|

|

Fufeng Group Co., Ltd. (Zhalantun Plant)

|

1,100

|

77%

|

|

Fufeng Group Co., Ltd. (Hohhot Plant)

|

850

|

84%

|

|

Ningxia EPPEN Biotech Co., Ltd.

|

550

|

83%

|

|

Shandong Linghua MSG Incorporated Co.,

Ltd.

|

300

|

90%

|

|

Xinjiang Meihua Amino Acid Co., Ltd.

|

300

|

90%

|

|

Baoji Fufeng Biotechnologies Co., Ltd.

|

300

|

60%

|

|

COFCO Biochemical (Anhui) Co., Ltd.

|

300

|

90%

|

|

Shandong Sanjiu MSG Co., Ltd.

|

250

|

94%

|

|

Fujian Jianyang Wuyi MSG Co., Ltd.

|

250

|

93%

|

|

Zhuhai Yili Group Co., Ltd.

|

100

|

50%

|

Source: CCM

Entering Dec. 2015, downstream food

producers usually will launch replenishment, processing, production, sales and

transportation in advance to welcome the Chinese New Year’s Day and Spring

Festival. It will be the peak for downstream purchasing in China. What’s more,

in Nov., the average export price of MSG was USD1,177.23/t, over USD50/t higher

than the domestic market price. Manufacturers still have high enthusiasm for

import. These will increase the demand of downstream market. However, it is

predicted that the market supply would not be tight as last year since the

relatively high operating rate of domestic manufacturers in early period

increased the inventory.

Judging from the above circumstances, it is forecasted that the total output of

MSG will record a YoY rise of 9% in 2015, being 1.95 million tonnes.

For the export, thanks to China’s increasing export rebate rate of MSG (HS

code: 21039010) to 13%, manufacturers have high enthusiasm for export. It is

estimated that the export volume of MSG will total 420,000 tonnes, a proportion

of 22%, up slightly compared to 2014.

About

CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta.

We

will attend FIC in this week. If you would like to meet us for consultancy in

FIC, please get in touch with us directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: MSG