According

to CCM, China has put great efforts in increasing the planting area and the

output of corn seed in 2016. However, lesser will of innovation of Chinese

producers led to a slight profitability of the corn seed market.

Source: Baidu

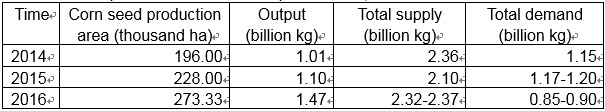

China’s

corn seed production experienced great growth in 2016, with an overall increase

in 33.67% in output and a rise of the production area by 19.89% compared to

2015. These numbers represent the second peak of production during the last 20

years, according to CCM’s research.

The

overall planting area of hybrid corn in China reached an amount of over 273

thousand ha in 2016. Looking at 2015, the amount has increased by more than 45

thousand ha during 2016. The harvest from this area weighted almost 1.5 billion

kg. The increase compared to the last year amounts 369 million kg.

CCM

explains this development with two main reasons. The first one is, that China

was facing a boom in authorised new varieties of corn seeds, leading to the

increase of the planting area of those. Secondly, the crop damage as a result

of natural disasters has not been as critical as in recent years, allowing the

much higher output of corn seeds compared to last year.

In

fact, the northwest of China was the only region that endured some natural

complications namely extreme temperature fluctuations, wind hail, diseases, and

pests. However, the harvest of crop per unit area did still experience an

increase of 3% up to 6% in comparison to 2015.

The

corn seed production area and output in China, 2014-2016

Source:

The National Agriculture Technology Centre

According

to the Seed Information and Technology Department of the National Agricultural

Technology Centre, the oversupply of hybrid corn will even get worse in spring

and summer of 2017. It is estimated, that the overall amount of newly produced

corn seeds will succeed 2 billion kg in summer 2017. The output of 2016 has

been 1.465 billion kg.

Furthermore,

the planting area of corn seeds will be reduced, following the adjustment of

the planting structure and the sluggish commodity market of corn. The supply

and demand index is likely to hit a number around 1.80. Next year will also

lead to a higher competitiveness of corn seed, reducing the price of those to

some degree when finally getting stable at a low level. The high

competitiveness is explained by the NATC with the much higher supply compared

to the actual demand. The huge amount of over 2 billion kg supply will be

facing the much lower demand of around 1.15 to 1.2 billion kg.

As

a fact, China is currently reducing the agricultural area used for corn seeds

by over 3.33 million ha till 2020.

All

the described factors of low corn seed prices and high competitiveness have led

to a negative outlook for China’s farmers to plant corn seeds. Low incomes and

even losses are the inconvenient reality for many producers.

China

is the second biggest seed market worldwide at the moment with an amount of

planting seed by about 12.5 million tonnes. Compared to the USA, the corn

storage in China was almost double than the one in the USA. Looking 10 years back

in 2006/07, the corn storage had been pretty much the same.

About

CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.comor get in touch with us directly by

emailing econtact@cnchemicals.com or calling +86-20-37616606.