Summary: China's vitamin exports ticked up in Jan.–Feb. when its export

volume reached 58,029.15 tonnes, up 40.61% YoY and its value came to

USD481,046,620, up 46.27% YoY.

According to China Customs, domestic vitamin exports improved in Jan.–Feb.

2021, with

· volume: 58,029.15 tonnes, up 40.61% YoY over the

41,269.72 tonnes in Jan.–Feb. 2020;

· value: USD481,046,620, up 46.27% YoY over the

USD328,877,121 in Jan.–Feb. 2020.

In Jan.–Feb. 2020, domestic vitamin producers delayed production

resumption affected by COVID-19, leading to falling output and blocked

transport. This had an adverse effect on China's vitamin exports. As the

producers resumed production gradually since March 2020, vitamin operations and

exports have recovered. In Jan.–Feb. 2021, China's vitamin export experienced

an upturn with production and supply, transport and exports being normal.

In addition, vitamin exports during the period mainly focused on delivery

of previous orders placed in Q4 2020, when domestic vitamin lowered their

prices for destocking. In Jan. 2021, overseas customers worried about vitamin

shortages after the Chinese Spring Festival resulted from rising production

costs affected by price hikes of downstream chemical intermediates, cornstarch

and other vitamin raw materials. Therefore, they continued to imported products

at low prices from China, further pushing up the domestic vitamin exports.

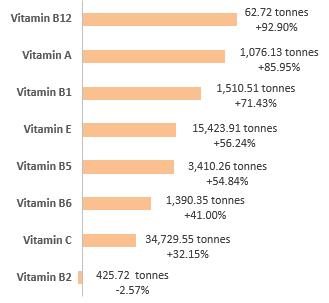

Among the eight vitamin varieties followed by CCM, seven of them,

including VA, VB1, VB5, VB6, VB12, VC and VE, enjoyed YoY growth in export

volume in Jan.–Feb.; while VB2 suffered decrease in export volume. VB12

witnessed the largest growth in volume with 62.72 tonnes, up 92.90% over the

32.51 tonnes in Jan.–Feb. 2020. VA came second with a volume of 1,076.13

tonnes, up 85.95% YoY vs. the 578.73 tonnes over last year. And VB1 followed

with a growth rate of 71.43% YoY, its volume increased to 1,510.51 tonnes from

the 881.10 tonnes in the previous year.

Figure Growth ranking of China's vitamin export volume in Jan.–Feb. 2021

(by variety)

Source: CCM & China Customs

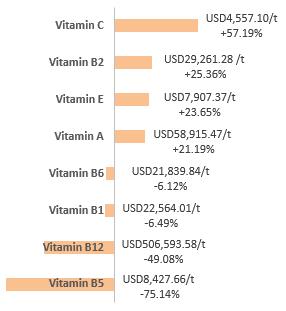

In terms of export price, prices of VA, VB2, VC and VE increased while

that of VB1, VB5, VB6 and VB12 decreased on a YoY basis. VC led the largest

growth of 57.19% YoY with the USD4,557.10/t price over the USD2,899.12/t price

a year ago. In contrast, VB5's export price fell to USD8,427.66/t from the

previous USD33,907.02/t, a decrease of 75.14% YoY.

Figure Growth ranking of China's vitamin export price in Jan.–Feb. 2021

(by variety)

Source: CCM & China Customs

Attention should be paid to VA and VC. The two varieties enjoyed sharper

decreases in both export price and volume.

VA:

· Volume: up 85.95% YoY;

· Price: up 21.19% YoY.

VC:

· Volume: up 32.15% YoY;

· Price: up 57.19% YoY.

BASF SE stopped offer quotations for its VA (1,000,000 IU) since March

2020. According to the company, it will not put the VA in normal sales in H1

2021. Meanwhile, its VA production line expansion project will be carried out

in H1 this year as scheduled. Therefore, it's VA cannot be in normal supply. In

Jan.–Feb. 2021, VA was poorly supplied in the European markets and its market

price hit USD92,246/t (EUR77,000/t, USD/EUR exchange rate @1.2043 on 15 April)

in Feb., an increase of 1.32% over the USD91,048/t (EUR76,000/t) in Jan. 2021.

BASF SE's tight supply of VA urged overseas customers to purchase from China,

making domestic producers and traders raise their vitamin prices.

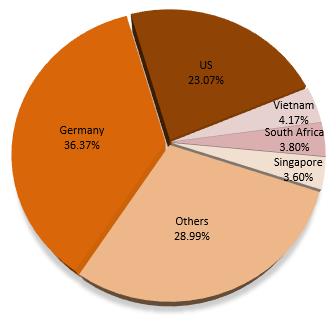

The top five destinations of the domestic VA export volume in Jan.–Feb.

and export values to them were:

· Germany: 391.41 tonnes; export value: USD21,475,614;

· The US: 248.30 tonnes, USD13,508,573;

· Vietnam: 44.87 tonnes, USD2,983,324;

· South Africa: 40.85 tonnes, USD1,494,743;

· Singapore: 38.71 tonnes, USD2,187,780.

Among them, China's export price to Vietnam was the highest, at

USD66,486.68/t; while the USD36,589.22/t export price to South Africa became

the lowest.

Figure China's VA export volume by destination, Jan.–Feb. 2021

Source: CCM & China Customs

VC is the global largest vitamin variety by output and sales; and VC's

export volume from China is the largest. The growth of China's VC export volume

and price was affected by commissioning of domestic new projects and stronger

demand for VC caused by COVID-19 as well as price hikes of its raw material,

cornstarch. On 15 Oct., 2020, Zhejiang NHU Co., Ltd. made an announcement that

its first phase of the Heilongjiang biological fermentation project had been

put into production. The project has a capacity of 30,000 t/a VC. Approximately

95% of VC is applied in food and pharmaceuticals. Amid the pandemic in 2020,

people pay more attention to VC's immunity function, increasing demand for VC

health-care products. Meanwhile, VC has been used for prevention and treatment

of COVID-19 in overseas medical institutions. Therefore, demand for VC was on

the rise. Cornstarch is an upstream raw material in the production of VC.

Cornstarch price in domestic market started to rise since Q2 2020, and it

averaged at USD573.33/t in Feb. 2021, up 65.43% YoY over the USD346.58/t a year

ago. The rising production cost has increased price of domestic VC.

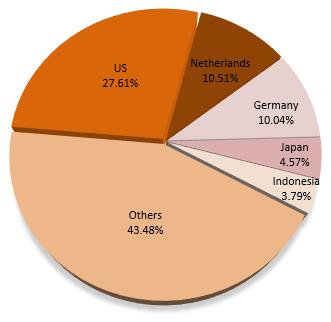

The top five destinations of the domestic VC export volume in Jan.–Feb.

were:

· The US: 9,589.68 tonnes, export value: USD45,380,002;

· The Netherlands: 3,649.17 tonnes, USD16,083,424;

· Germany: 3,488.28 tonnes; USD14,604,142;

· Japan: 1,588.80 tonnes, USD7,832,168;

· Indonesia: 1,316.08 tonnes, USD6,609,577.

Among the five countries, export price to Indonesia came to USD5,022.17/t,

the highest price and export price to Germany was USD4,186.63/t, the lowest.

Figure China's VC export volume by destination, Jan.–Feb. 2021

Source: CCM & China Customs

More information about China Vitamin Market you

can find at CCM Vitamin China monthly Newsletter.

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture,

chemicals, food & ingredients and life science markets. Founded

in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research

reports. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing emarket1@cnchemicals.com or calling +86-20-37616606.