On June 5, China’s Ministry of

Environmental Protection released a list of thirteen substitute refrigerants,

detergents and foaming agents it plans to support during China’s transition

away from HCFCs. The list featured ten natural substances and only one HFC.

The

First Catalogue of Recommended Substitutes for HCFCs does

not include any practical policy measures and is merely supposed to serve as a

general statement of intent by the government, but more substantial reforms are

sure to follow.

CCM spoke to a number of insiders

in China’s air conditioning and refrigerant industries in the wake of the

publication of the Catalogue to get a

sense of the mood in the two industries and how companies plan to move forward.

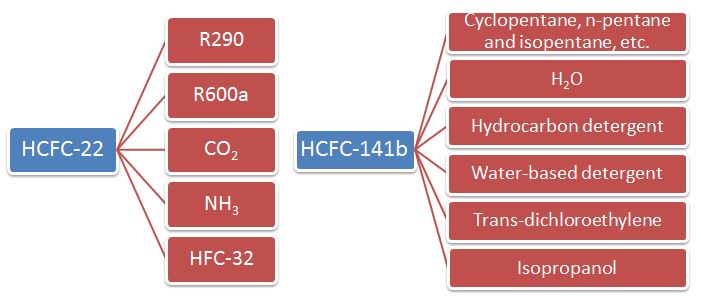

Figure

1: Recommended substitutes for HCFCs listed by China’s Ministry of

Environmental Protection

Source:

CCM

The

start of something big

All the insiders CCM spoke to are

under no illusions as to the Catalogue’s significance. All agreed that the Catalogue is almost certainly the

prelude to a government campaign to promote natural refrigerants at the expense

of HFCs.

As with China’s previous drive to

support R290 air conditioners, policy measures that are likely to follow

include subsidies to help producers overhaul their production lines, price

subsidies for products containing natural refrigerants and support in promoting

these products.

However, there was a general

consensus that the HFC industry is unlikely to be affected for at least the

next 1-2 years as it will take time for these policies to be implemented.

Air

conditioner manufacturers: playing it by ear

The attitude among air conditioner

manufacturers is generally one of reluctant compliance. The government has been

promoting R290 in recent years, but Chinese consumers have shown little

enthusiasm for paying extra for these more environmentally-friendly products.

As a result, manufacturers have little incentive to invest in expanding

production of R290 without further government incentives.

“We officially launched R290 air

conditioners in H1 2015, as the government has offered to support R290 as a

substitute for difluorochloromethane (HCFC-22) in household air conditioners

since 2011. Many supporting policies have been issued, covering production,

application, promotion and sale,” said an engineer from Gree Electric

Appliances.

“But we have kept production small

because the HCFC-22 and HFC-410a (a 1:1 mixture of difluoromethane – HFC-32 and

pentafluoroethane – HFC-125) air conditioners still play a vital role in the

market, with 80%+ sales in total, whilst the rest is partially claimed by

HFC-32 air conditioners. R290 air conditioners still account for a small share.”

However, Gree Electrical Appliances

received its first order for R290 air conditioners from a public institution in

June – an order from Shenzhen University for 243 units. If the company starts

to receive more of these government contracts, it may be tempted to expand

production further.

Fluorine-enriched

refrigerant producers: looking to make hay while the sun shines

Chinese producers of HCFC and HFC

refrigerants recognize that the tide is beginning to turn away from them, but

most of them remain bullish about their prospects for the immediate future.

A representative of Zhejiang Sanmei

Chemicals underlined this point by pointing out that his company’s sales of HFC-134a

aerosol cans (net weight: 200-250 g/can) during the first half of 2015 were up

over 70% year on year. Zhejiang Sanmei Chemicals is still the market leader in

vehicle air conditioner refrigerants and it expects HFCs will continue to

dominate this market for some time to come.

Sinochem Lantian, a subsidiary of

Sinochem Group that specializes in fluorine chemicals, also expects sales of

HFCs to continue growing unless practical policies are introduced to promote

natural refrigerants:

“HFCs, mainstream substitutes for

HCFCs, have already been applied widely”, said a sales manager from the

company. “Now the vehicle air conditioning segment, as a whole, has adopted

1,1,1,2-tetrafluoroethane (HFC-134a); in the domestic air conditioning sector,

the proportion of HFC-410a air conditioners has been increasing, now equal to

that of traditional HCFC-22 ones”.

The sales manager attributed the

government’s support for natural refrigerants to the EU’s new F-Gas Regulations, which will gradually

phase out the use of HFCs over the next fifteen years. However, China has not

yet introduced similar restrictions on the HFC industry, and natural

refrigerants will struggle to compete until it does so.

However, despite the brave face the

industry is putting on, there is sure to be widespread concern about the

long-term future of HFCs in China.

Many manufacturers are already

struggling due to the severe overcapacity in the industry, with operating rates

among producers of HFC-134a, HFC-410a, HFC-32 and HFC-125, all under 60%. Prices have also

fallen dramatically as a result – in the case of HFC-134a, prices have

plummeted 300% from 2010-2012 levels.

The only route out of this overcapacity crisis is through increasing

demand for HFCs, but the government’s evangelizing of natural refrigerants

threatens to make this impossible.

For now, it is a case of ‘keep calm

and carry on’ for both air conditioner and refrigerant companies, but both

groups will be keeping a close eye on the government as they wait for its next

move.

CCM

is the leading provider of market intelligence on China’s chemicals market. For

more information about CCM and its coverage of refrigerants in China, please

visit www.cnchemicals.com or get in touch directly by

emailing econtact@cnchemicals.com or calling +86-20-37616606.