According to CCM, Henan Billions released its Q3 2015 financial report, presenting a YoY increase in revenue and a YoY decrease in net profit. As domestic market conditions were so depressed in this period, CCM thinks that such a mild sliding performance is acceptable. In fact, CCM believes that an advanced production and sales scale as well as a fine industry chain system will promise Henan Billions a bright future. Besides, Henan Billions’ chloride-processed TiO2 project is worth noting and it may be a new profit generator for the company in the future.

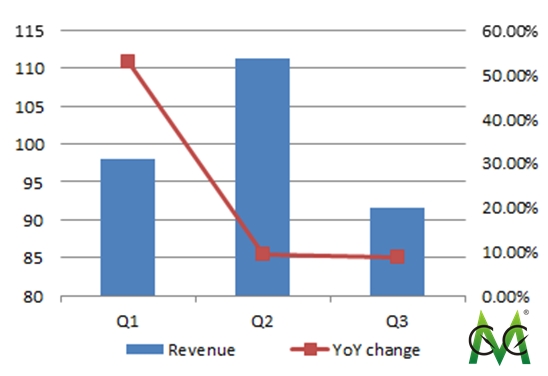

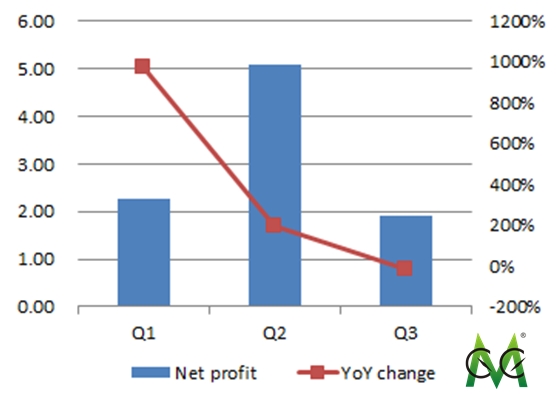

On 27 Oct., 2015, Henan Billions Chemicals Co., Ltd. (Henan Billions) released its financial report for the third quarter of 2015 (Q3 2015). Accordingly, during the report period, Henan Billions gained a revenue of USD91.52 million (RMB578 million) with a YoY increase of 8.67% and a net profit of USD1.90 million (RMB12.03 million) with a YoY decrease of 15.38%.

Meanwhile, Henan Billions predicted that its net profit for the full year of 2015 will be about USD10 million (RMB63.14 million) to USD15 million (RMB94.71 million).

Henan Billions attributed its decreasing net profit to the following two reasons:

- After July 2015, output of coatings which are downstream products of TiO2, tumbled influenced by the collapsing growth of investment into the real estate industry;

- Weak demand for TiO2 from downstream markets led to a decrease of nearly 10% in TiO2 quotation and the real transaction price of TiO2 even fell more dramatically.

In Q3 2015, Henan Billions further controlled its production costs and gained a gross profit margin of 16.90%. That’s why its net profit didn’t drop significantly under such market conditions.

Revenue of Henan Billions in Q1-Q3 2015, million USD

Source: CCM & Henan Billions

Net profit of Henan Billions in Q1-Q3 2015, million USD

Source: CCM & Henan Billions

According to CCM, market price of TiO2 in China has dropped to below the production costs. At the end of Q3 2015, it dropped by 20% compared with that at the beginning of the quarter. Many small-and-medium-sized TiO2 enterprises are facing crisis of capital chainrupture and forced to stop production. Even large-scale companies are not able to immune to such depressed market conditions. Anhui Annada Titanium Industry Co., Ltd., a Chinese listed TiO2 company, announced a loss up to USD6.49 million (RMB40.97 million, diving by 575.49% YoY) in its Q3 2015 financial report.

Market conditions of TiO2 were so depressed. However, Henan Billions was able to maintain a positive profit. This reflects that Henan Billions’ profitability is dominant.

After acquiring Sichuan Lomon Titanium Co., Ltd. (Sichuan Lomon) by issuing private placement in May 2015, Henan Billions has become the absolute leader in China’s TiO2 industry with a total capacity reaching 560,000 t/a. It enjoys the TiO2 pricing right and discourse power in the industry.

CCM believes that Henan Billions has become a wind vane in Chinese TiO2 market for the following three reasons:

1. By acquiring Sichuan Lomon, Henan Billions introduced advanced technologies to minimize its weakness in medium-and-high-end sulfate-processed rutile TiO2 business. Besides, the combination of the two giants’ marketing channels also helps Henan Billions to further enlarge its market shares.

2. From raw materials of titanium ore, high titanium slag and sulfuric acid to TiO2, high-grade titanium materials and titanium gypsum, Henan Billions now has owned a complete titanium industry chain. This is conducive to controlling its production costs.

3. Since 2013, Henan Billions has always had the highest proportion of export volume to total output among Chinese TiO2 companies. Its layout and exploitation of the overseas market helps Henan Billions to avoid price wars when market demand is weak in Chinese market. According to statistics from the General Administration of Customs of the P.R.C., Henan Billions exported 58,986 tonnes of TiO2 in total in Jan.-Aug. 2015, accounting for 15.03% of the total of the nationwide. Major export destinations of Henan Billions’ TiO2 products are Brazil, India and the US.

Meanwhile, Henan Billions’ chloride-processed TiO2 project is worth noting.

Currently, China imports about 200,000 tonnes of chloride-processed TiO2 annually, reflecting a great market demand in China. As the fourth TiO2 company to enter the chloride-processed TiO2 industry in China, Henan Billions built a 60,000 t/a chloride-processed TiO2 plant at the end of 2014 and put it into stand-alone debugging after the Chinese Spring Festival and linkage debugging in Q3 2015. Henan Billions disclosed that the project was expected to be put into normal production at the end of 2015. If so, this new project will be a new profit generator for Henan Billions. It will help Henan Billions to grasp opportunities in the tense market competition and then further enhance its profitability.

If you want to know more about the TiO2 industry, you can have a look at one of our products: Titanium Dioxide China Monthly Report.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: Titanium dioxide, Henan Billion