In

March 2016, Meihua Bio released its

2015 financial figures. Its revenue increased while net profit decreased,

influenced by rises in sales volumes and falls in sales prices. In 2016, the

company will continue focusing on high value-added amino acids, like lysine and threonine.

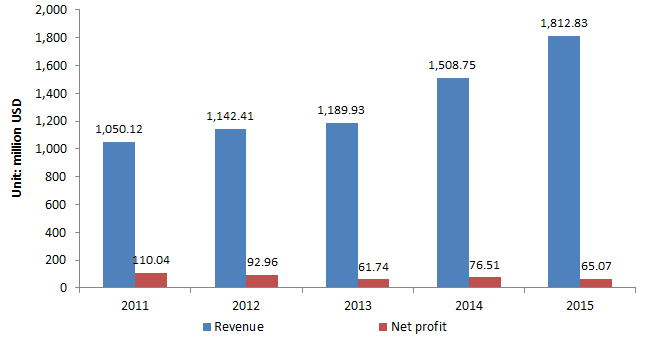

On 1 March, 2016, Meihua Holdings Group Co., Ltd.

(Meihua Bio) released its 2015 financial figures. Specifically, its revenue

achieved USD1.81 billion (RMB11.85 billion), up by 20.15% over 2014, while the

net profit was USD65.07 million (RMB425 million), down by 14.95%. This was

mainly caused by rises in sales volumes and falls in sales prices.

- Sales volume of glutamic acid and monosodium

glutamate

-

Small

packs: 29,000 tonnes, down by 1,600 tonnes YoY

-

Large

packs: 650,000 tonnes, up by 140,000 tonnes YoY

-

Glutamic

acid: very small proportion in this business

This was mainly because Meihua Bio shifted the strategy from expanding terminal

markets, such as supermarkets, to developing clients preferring large packs.

- Sales volume of other amino acids

-

70%

Lysine: 206,000 tonnes, up by 79,000 tonnes YoY

-

98%

Lysine: 127,000 tonnes, up by 38,000 tonnes YoY

Thanks to the 10,000 t/a production line in Xinjiang production base,

production has continued to increase since it went into operation in 2014.

Moreover, Meihua Bio took up bigger shares in lysine market when Global

Bio-chem Technology Group Co., Ltd.’s production line (600,000 t/a) was shut

down due to the company’s restructuring from March to Dec. in 2015.

-

Threonine:

68,000 tonnes, up by 30,000 tonnes YoY

This increase was mainly promoted by the continuous capacity release of the

60,000 t/a threonine project in Xinjiang production base.

Notably,

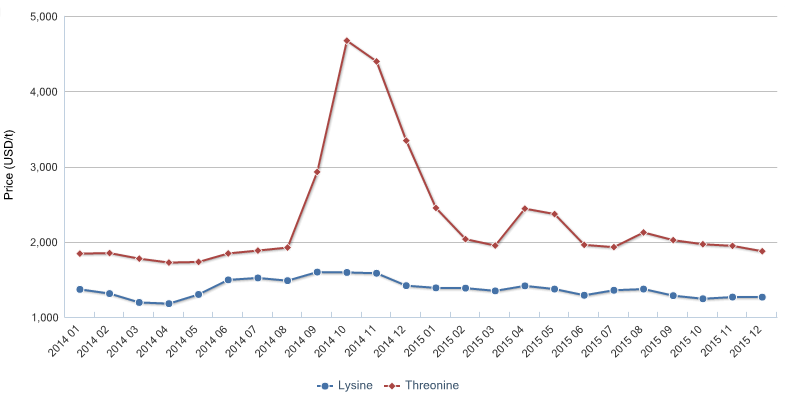

part of the Meihua Bio's amino acids' sales prices kept falling. According to

CCM’s research, the average price of the company's 98% lysine in 2015 was

USD1,245/t, decreasing 6% YoY; 99% threonine’s sales price even declined by 50%

to USD2,140/t. The gross profit margin thus fell to 15.86%, down by 4.59

percentage points, lowering the net profit.

Meihua Bio's

financial performance, 2011-2015

Source: Meihua Holdings Group Co., Ltd.

Meihua Bio’s

production and sales volume of selected products, 2015

|

Product

|

Production,

tonne

|

Sales

volume, tonne

|

Stock,

tonne

|

|

Monosodium glutamate

& glutamic acid

|

694,021

|

707,393

|

11,592

|

|

Lysine

|

305,551

|

332,784

|

3,329

|

|

Threonine

|

*152,815

|

168,258

|

3,635

|

|

Xanthan gum

|

11,330

|

16,359

|

8,801

|

|

Disodium

5’-ribonucleotide

|

4,191

|

7,163

|

123

|

|

Glutamine

|

2,724

|

2,096

|

1,418

|

|

Tryptophan

|

1,485

|

1,549

|

49

|

|

Isoleucine

|

311

|

294

|

185

|

Note: *152,815 (output)> 145,000

t/a (designed capacity), thanks to technological upgrading in 2015, according

to Meihua Bio.

Source: Meihua Holdings Group Co., Ltd.

Notably,

part of theMeihua Bio's amino acids' sales prices kept falling. According to

CCM’s research, the average price of the company's 98% lysine in 2015 was

USD1,245/t, decreasing 6% YoY; 99% threonine’s sales price even declined by 50%

to USD2,140/t. The gross profit margin thus fell to 15.86%, down by 4.59

percentage points, lowering the net profit.

Monthly market prices

of 98.5% lysine and 99% threonine in China, 2014-2015

Source: CCM

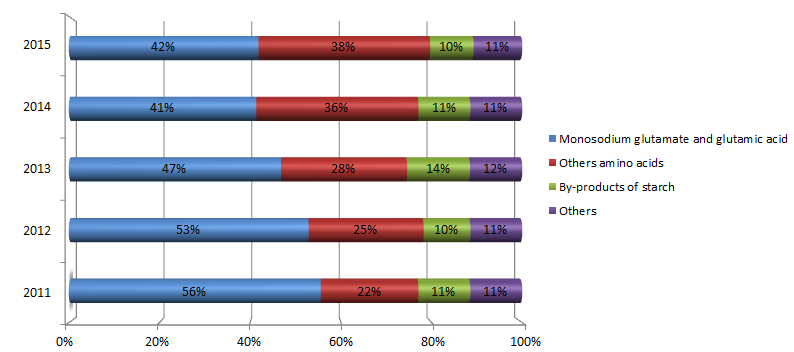

Meihua

Bio shifted its focus from glutamic acid and monosodium glutamate to other

amino acids. From 2011 to 2015, the percentage that glutamic acid and

monosodium glutamate took up in the total revenue fell from 56% to 42%, whereas

the percentage of other amino acids, especially lysine and threonine, rose from

22% to 38%. Meihua Bio has stood firm in the monosodium glutamate and glutamic

acid market, accounting for 35% of the sales in 2015. Therefore, the company

will mainly focus on the business of high value-added amino acids to seek new

profit growth and construct a global-scale amino acid production base.

Meihua Bio believes,

“The trend of 'oligopoly' will be more obvious in amino acid market in 2016.”

In 2015, China's amino acids were under oversupply. For instance:

Lysine:

-

Capacity:

1.8 million t/a

-

Output:

1.3 million tonnes

Threonine:

-

Capacity:

580,000 t/a

-

Output:

300,000 tonnes

Consequently, enterprises compete for bigger shares in the overseas market to

increase sales. Several lysine and threonine giants have emerged after capacity

expansion and intense market competition. At present, Ningxia EPPEN Biotech

Co., Ltd., Global Bio-chem Technology Group Co., Ltd. and Meihua Bio are the

top three lysine giants in China, combined to take up 70%+ of the sales. The

top two threonine giants include: Fufeng Group Co., Ltd. and Meihua Bio,

combined to take up 60%+ of the sales.

For

this, in 2016, Meihua Bio plans to:

-

Improve

manufacturing techniques to lower production cost

-

Develop

end clients like feed mills and big clients in the overseas market to

boost sales and realize the goal of zero stock

Meihua Bio's product

structure by revenue, 2011-2015

Source:

Meihua Holdings Group Co., Ltd.

About CCM:

CCM is the leading

market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to

industry newsletters and customized market research reports. Our clients

include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of

Kcomber Inc. More about CCM, please visit www.cnchemicals.com.

We will attend FIC in the coming week. If you would like to meet us for consultancy in FIC, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.