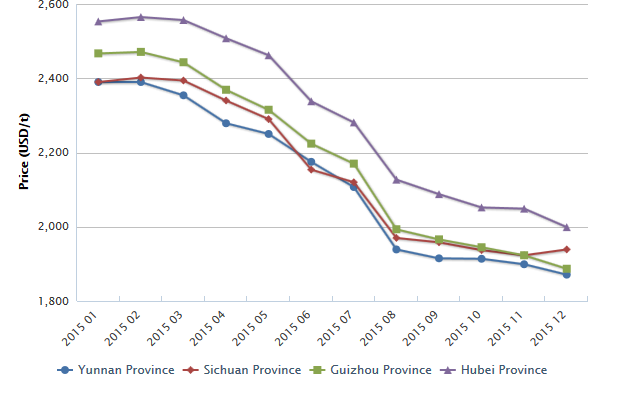

According to CCM’s statistics, market price of yellow phosphorus slumped in

China in 2015. The average price dropped from USD2,365/t (RMB15,500/t) in 2014

to USD2,106/t (RMB13,800/t) with a YoY decrease of 10.95%.

Specifically, domestic yellow phosphorus price slid after Chinese Lunar New

Year for the following three reasons:

- In 2015, the traditional peak season for the glyphosate market was not as

prosperous as previous years, leading to a stagnant demand for yellow

phosphorus. To reduce inventory pressure and recoup funds, yellow phosphorus

manufacturers had no choice but to reduce product price to increase sales

volume;

- The preferential electricity price policy was put into implementation in

Yunnan Province. During the low-flow period, production costs were able to be

reduced and this gave opportunity to downstream companies to put pressure on

yellow phosphorus manufacturers to lower their prices;

- Influenced by depressed market conditions, many phosphate manufacturers

frequently suspended production and this has affected the sales of yellow

phosphorus.

Considering that market conditions of downstream products such as phosphoric

acid, glyphosate and phosphate will not be improved in the short time, CCM

predicts that China's yellow phosphorus market may continue to be depressed in

2016.

- Forecast of supply of yellow phosphorus in China.

In 2015, about 1.72 million t/a of yellow phosphorus was put into production

(some manufacturers stopped production in 2015 and their capacity was excluded)

and the actual annual output reached approximately 666,000 tonnes with an

operating rate of only 38.70%.

Based on the current market conditions, the overall structure of the downstream

market of yellow phosphorus will not be greatly adjusted. Thus, demand from

downstream markets will not be able to support the yellow phosphorus market to

recover. So, CCM predicts that in 2016 domestic yellow phosphorus manufacturers

will remain low operating rates and only slightly adjust the rates according to

market fluctuations.

- Forecast of price of yellow phosphorus in China

CCM predicts that in 2016, market price of yellow phosphorus will be stable at

USD1,831/t-USD2,060/t (RMB12,000/t-RMB13,500/t) for the following reasons.

1. Currently, China's phosphoric acid and glyphosate industries are in the

depression. Reaping few profits, downstream purchasers would put heavier

pressure on yellow phosphorus manufacturers to lower their prices in order to

reduce cost pressure. In other words, yellow phosphorus manufacturers have no

supports to raise their prices.

2. Electricity price which will influence production costs is expected to be

reduced after reforms. Since 2015, Chinese government has been planning reforms

to cut coal electricity price in most areas in China. In addition, approvals to

electricity price reforms plans in Yunnan and Guizhou provinces have made the

reforms more feasible. After yellow phosphorus manufacturers successfully

reduce their production costs, they will face heavier pressure from downstream

purchasers' require for lower prices.

Ex-works price of yellow phosphorus in China by month, Jan.- Dec. 2015

Source: CCM

This article comes from Phosphorus Industry China Monthly Report 1602, CCM

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: phosphorus