CCM listed the 2015 top 10 TiO2 enterprises

based on production capacity, output, exports and internet search frequency.

Sichuan Lomon topped the list, followed by Henan Billions and CNNC TD.

China’s TiO2 market was in full swing in

2015. In the first half of the year (H1 2015), Henan Billions Chemicals Co.,

Ltd. (Henan Billions) announced its acquisition of China’s leading TiO2 player,

Sichuan Lomon Titanium Co., Ltd. (Sichuan Lomon). The proposed marriage between

the two giants boosted the domestic market.

However, in the second half (H2 2015),

market conditions slumped due to insufficient market demand. Market prices of

both rutile and anatase TiO2 dropped to historic lows and domestic

manufacturers struggled.

CCM has compiled a list of the top 10

Chinese TiO2 enterprises in 2015 based on comments from industry insiders and

trade sources as well as data such as production capacity, output, exports,

internet search frequency (baidu.com) and trade volumes through e-commerce

(Alibaba.com).

Chinese top 10 TiO2 enterprises in 2015

Note:

"-" refers to no changes in ranking.

Source: CCM

- Top 1: Sichuan Lomon

Sichuan Lomon continued to top the list in

2015, well ahead of others in terms of production capacity, output and export

volume.

Its major product, R996, sold at an annual

average price of USD1,810.58/t, was well recognised by downstream enterprises

as being of reliable quality as well as having the best performance-to-cost

ratio among Chinese TiO2 products. Additionally, R996 was also the most

frequently searched TiO2 product on both China’s major internet search engine

(baidu.com), and e-commerce platform (Alibaba.com), in 2015.

- Top 2: Henan Billions

The breaking news released on 5 May, 2015

that Henan Billions was working on the acquisition of Sichuan Lomon (not closed

yet) for a time made the former the most frequently searched enterprise on

baidu.com.

Henan Billions has maintained stable growth

in output in recent years. It produced a total of 208,702 tonnes of TiO2 in

2015, growing by 7.14% YoY. Additionally, its 60,000 t/a chloride grade TiO2

project was put into trial production in H2 2015 and its self-developed

chloride grade TiO2 products, BLR895 and BLR896, were officially endorsed by

PPG Industries, Inc.

- Others

Jinan Yuxing Chemical Co., Ltd. (Jinan

Yuxing): ranking dropped from No.5 in 2014 to No. 9 in 2015 due to significant

cut in output;

Pangang Group Vanadium & Titanium

Resources Co., Ltd. (stock code: 000629): climbed from No.9 in 2014 to No. 6 in

2015 because of a remarkable growth of 18% YoY in output.

The gaps between the top 4 enterprises were

relatively large, while the margins between the last 6 were not.

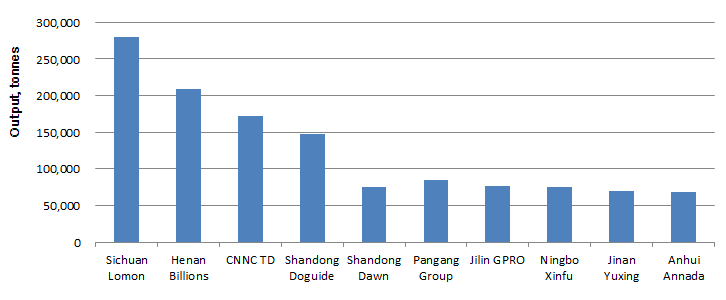

Output

According to CCM’s research, in 2015

China’s TiO2 output totaled about 1.98 million tonnes, down by 5.71% YoY. Of

this, the top 10 enterprises contributed 62.96%, up 8.44 percentage points over

54.52% in 2014.

TiO2 output of top 10 TiO2 enterprises in

China, 2015

Source: CCM

With an output of 280,000 tonnes, Sichuan

Lomon was way ahead of the field, 14.14% of the national total. Shandong

Doguide Group Co., Ltd. had the fastest growth rate of the 10, up 31.56% YoY

from 112,500 tonnes to 148,000 tonnes in 2015. Of the other 8 enterprises, 2

recorded YoY falls in output. They were Jinan Yuxing and Anhui Annada Titanium

Industry Co., Ltd.

Unlike leading enterprises, a large number

of Chinese mid-sized TiO2 enterprises, such as Panzhihua Taihai Technology Co.,

Ltd. and Yunnan Dahutong Titanium Industry Co., Ltd. reduced their operating

rates in H2 2015 following the collapse of the TiO2 price. Some small-sized

companies like Chongqing Xinhua Chemical Co., Ltd. and Hengyang CNSG Tianyou

Chemical Co., Ltd. even suspended production. As a result, China’s annual TiO2

output dropped for the first time and the industry became significantly more

concentrated.

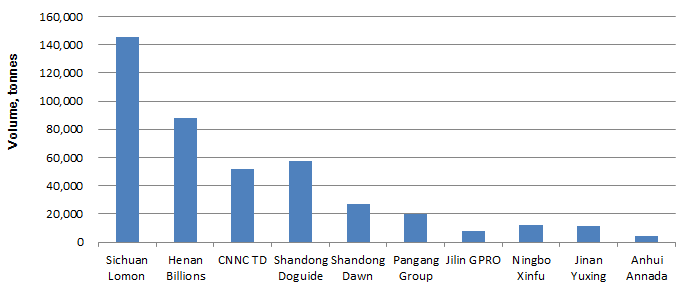

Exports

According to data from China’s Customs,

China exported a total of 593,100 tonnes of TiO2 in 2015, down by 2.60% YoY.

The top 10 enterprises accounted for 74.36% of total exports.

Exports of TiO2 from top 10 TiO2

enterprises in China, 2015

Source: CCM & China Customs

Export volumes of TiO2 from most of the top

10 enterprises fell slightly YoY in 2015, mainly because of stagnant demand

from the global market. Chinese TiO2 enterprises suffered heavy pressure from

overseas purchasers to lower prices and the average export price in Dec. had

dropped by 21.48% compared to that in Jan. 2015.

Though the Chinese TiO2 export business

fell slightly YoY in 2015, it has played an increasingly important role as a

means of de-stocking for domestic TiO2 enterprises. In particular, that year,

total TiO2 export volume accounted for 29.95% of the national total output,

increasing slightly compared with 28.98% in 2014.

Sichuan Lomon, Shandong Dawn Group Co.,

Ltd. (Shandong Dawn) and Ningbo Xinfu Titanium Dioxide Co., Ltd. were the only

enterprises that witnessed increased export volumes in 2015. Specifically,

Sichuan Lomon’s export volume increased by 7.21% YoY to 145,418 tonnes, with

the destination of exports mostly being South Korea, the US, India, and

countries in Southeast Asia. Shandong Dawn exported 27,255 tonnes of TiO2,

growing by 24.84% YoY, and exporting mainly to India, the US and Brazil.

So far in 2016 (as of Aug.), China’s TiO2

industry has continued to recover following an all-time low in 2015. The

domestic output, export volume and market price of TiO2 have all showed upward

trends. With this in mind, CCM expects major domestic leading TiO2 enterprises

to record slight increases in their output and export volume this year.

Jilin GPRO Titanium Industry Co., Ltd. may

see its position within the industry improve in 2016 due to an 80,000 t/a TiO2

project of its subsidiary, Xuzhou Titanium Dioxide Chemical Co., Ltd., being

expected to reach production capacity this year.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in

touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.