Summary: The USDC canceled the anti-dumping

duty levied on xanthan gum which Meihua Bio exported to the US, widening the

difference of anti-dumping duties between China’s xanthan gum enterprises. CCM

believes that this may boost the internal cooperation of enterprises.

On 20 May, 2015, Meihua Holdings Group Co.,

Ltd. (Meihua Bio) released the final decision on anti-dumping of its xanthan

gum. In order to protect the self-interests, in H2 2013, Meihua Bio applied to

the United States Department of Commerce (USDC) for a review on the original

judgment that the USDC will levy 15.09%-154.07% anti-dumping duty on China’s

xanthan gum. After over two years’ investigation, on 18 May, 2015, the

International Trade Commission (ITD, USDC) made a final decision, indicating

that Meihua Bio and its subsidiaries do not sell xanthan gum at the price which

is lower than the normal. This means that Meihua Bio has no anti-dumping

measures on xanthan gum. Therefore, the USDC cancel the anti-dumping duty on

Meihua Bio’s xanthan gum.

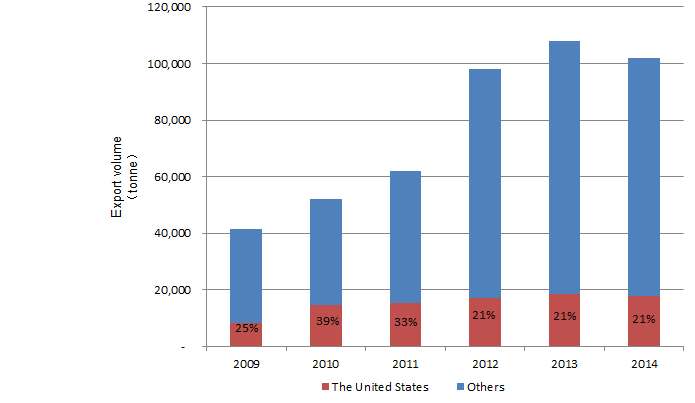

It is a great loss for both Chinese

enterprises and China that the USDC levies anti-dumping duty on China’s xanthan

gum. On one hand, the US is the major export destinations of xanthan gum in

China; the export volume of xanthan gum China exporting to the US accounts for

about one-fourths of the total. The levy of anti-dumping duty changes the

pattern of xanthan gum export destination in China. Without price advantages,

some small enterprises are forced to give up the American market. On the other

hand, high anti-dumping duty forces enterprises to increase their export price;

therefore, downstream customers are likely to purchase low-priced and

low-quality substitute, guar gum. India and Pakistan are two largest producers

of guar gum in the world.

In 2013, the USDC accepted the request from

the American largest xanthan gum producer, CP Kelco, to conduct anti-dumping

investigation on China’s xanthan gum. On 20 June, 2013, the ITD, USDC finally

affirmed that the xanthan gum imported from China threatens or damages related

industries in the US and the US will levy 15.09%-154.07% anti-dumping duty on

China’s xanthan gum.

Export volume of China's xanthan gum,

2009-2014

Source: China Customs

After the USDC canceling anti-dumping duty

on Meihua Bio’s xanthan gum, Meihua Bio will enjoy more significant advantage

in export. It is disclosed that now the difference between the anti-dumping

duty rate on Meihua Bio's xanthan gum and Chinese general one reaches 154.1%.

This provides capital strength for Meihua Bio to exploit the American market

with lower export price. CCM believes that the high duty difference between

Chinese xanthan gum enterprises may advance their cooperation. For example,

those enterprises levied higher anti-dumping duty will sell their products to

those with lower anti-dumping duty and the latter will export these products

instead. Finally, they achieve the win-win situation. For Meihua Bio, since the

US demands a large quantity of xanthan gum, it cannot satisfy the demand only

by itself. Through cooperation, the popularity of Meihua Bio will also be

greatly promoted. For those enterprises which have been levied a high

anti-dumping duty, the export costs will be also reduced through the

cooperation.

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.