Summary: In late June 2015, Zhonglin

Chemical (in Sichuan Province) announced to launch a R32 refrigerant project.

In the light of the continuously increasing production capacity all around the

country, CCM expects no recovery in the R32 market, along with fiercer price

competition and long-lasting low price.

On 20 June, 2015, Sichuan Jiangyou Zhonglin

Chemical Co., Ltd. (Zhonglin Chemical) announced the plan to launch a

difluoromethane (R32) refrigerant project in the 4th quarter, 2 production

lines included to total 3,000 t/a. Now the project is under environmental

impact assessment.

According to CCM research, the production

capacities that are under construction in Shandong and Qinghai provinces are

combined to reach 20,000 t/a, whilst that in regions like Jiangxi and Fujian

provinces will also increase, however just under planning.

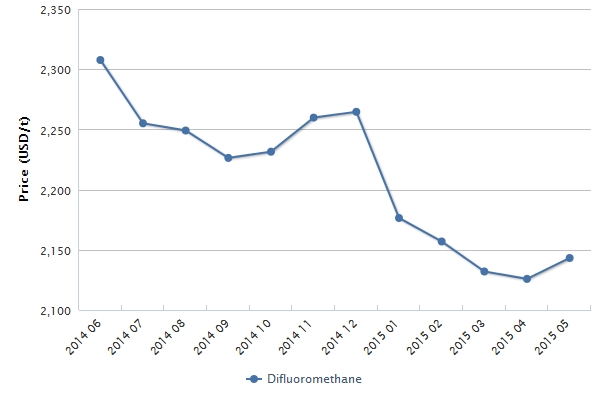

Ex-works price of difluoromethane in China, June 2014–May 2015

Source: CCM

The move to expand the R32 production

capacity can be attributed to the increasing downstream demand and the

government support.

In recent years, the Chinese government, in

an attempt to protect the environment, has been strongly recommending and

supporting the application of propane (R290) as the 1st substitute for

difluorochloromethane (R22). However, R290, due to the characteristics of

flammability and explosibility, is strictly restricted in charge volume and is

now only applied in household split-type air conditioner and small-scale

refrigerating equipment, unable to satisfy the demand from other fields, such

as industrial and commercial air conditioner and medium- and large-size

refrigerating unit.

At this moment, R32 gets in the market.

Inferior to R290, its advantage in environmental protection is still far beyond

that of other substitutes for R22, such as R410a (a 1:1 mixture of R32 and

pentafluoroethane – R125). Moreover, the limit on the charge volume of R32 is

relatively loose, as it is not too easy to flame. This enables it to be used in

the aforementioned fields where R290 is not applicable.

Hence in 2015, the scaled application of

R32 in China has been accelerated. Many compressor (core component in air

conditioner) enterprises announced the success in the R&D and mass

production of R32 compressor. According to statistics, the output of R32

compressor increased by 50%+ YoY during January-May. Enterprises like Gree

Electric Appliances, Inc. of Zhuhai, Midea Group and Haier Group have launched

R32 air conditioners onto the market in succession.

Also in June, the Chinese government

solicited public opinions on the First Catalogue of Recommended Substitutes for

HCFCs (HCFC stands for hydrochloroflurocarbon), in which R32 is listed as the

only fluorine-enriched refrigerant. This manifests that the government will

encourage the promotion and application of R32.

However, the R32 industry in fact is

trapped in relatively severe overcapacity. CCM believes that the continuously

increasing production capacity will nullify the drive offered by the

strengthened downstream demand and the guidance and support provided by the

government.

To date the domestic production capacity of

R32 has totalled 220,000 t/a, excluding those under construction. In recent

years, the average operating rate of R32 enterprises has stayed at around 50%.

Specifically in 2014, the full-year operating rate averaged only about 45%,

suggesting a serious overcapacity in the industry. Impacted by this, the R32

market has entered the downward trend since H2 2014. In May 2015, the price

declined by 7.15% over that in June 2014, causing a narrowed profit margin.

Statistics has it that the downstream

consumption of R32 in 2014 summed up to about 100,000 tonnes. In 2015, the

demand will increase to around 120,000 tonnes, however only about 54% of the

total capacity.

To suppose that R32 will play a full role

in replacing R22 every year during the elimination and that the R32 capacity

will not further increase and stay at the current level, only from 2020 can

oversupply be eased.

So, the production capacities that have

been newly established or are to be established later, may completely cancel

out the downstream demand increased through eliminating R22, and will even

intensify the overcapacity. Then, the R32 industry will not rebound, along with

fiercer price competition and long-lasting low price.

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.