Price war has come to a close in China’s

ace-K market in May 2016. Instead, the price increased continuously. Analyst CCM expects that the ace-K price will

show slow rises and maintain stability in the near future, since many

manufacturers increase production and giant player Anhui Jinhe intends to

capture more shares.

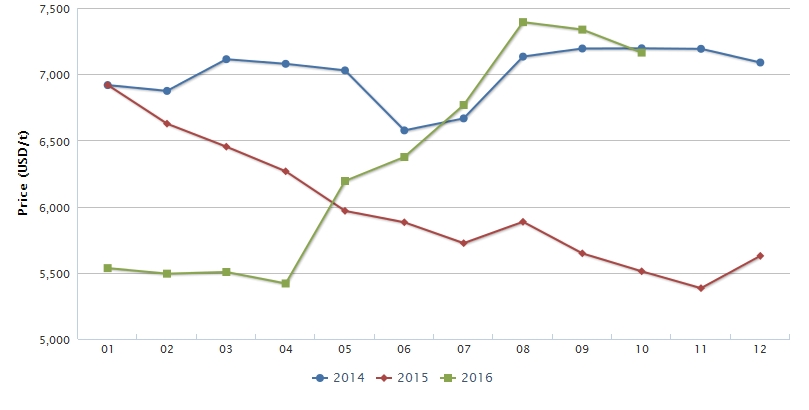

According to CCM’s price monitoring, the

ex-works price of acesulfame-K (ace-K) hit USD7,163/t in Oct. 2016, up by 29.97% YoY. Regarding the

price trend in Jan.-Oct. 2016, the Jan.-April 2016 prices hit historic low

since 2014. However, the price kept rising since April 2016 and it rose 36.43%

in Aug. compared to than in April.

Ex-works price of acesulfame-K in China, Jan.

2014-Oct. 2016

Source: CCM

Intense

supply supports price rise

“The intense supply of ace-K due to production

suspension from major ace-K manufacturers in China supported the price rise in

April – Aug. 2016,” stated Yang Yimin, editor of Sweeteners

China News, CCM.

China’s ace-K market showed large

fluctuations since 2015. In Feb. 2015, key manufacturer Suzhou Hope Technology

Co., Ltd. (Suzhou Hope, production capacity: 10,000 t/a) was involved in

bankruptcy and reorganisation. Though it restarted production in late 2015, its

shipments were small.

Suzhou Hope is not alone. In April 2016, another

manufacturer of ace-K raw material, Jiangsu Tiancheng Biochemical Products Co.,

Ltd. (Jiansu Tiancheng), a key diketene (DK) manufacturer (production capacity:

40,000 t/a, 20% of the national figure) suspended production for environmental

problem and has yet to resume production so far.

Moreover, in July, an explosion happened to

another DK manufacturer Wanglong Group (production capacity: 70,000 t/a), for

which to date it has yet to restart production.

According to CCM’s research, the combined DK

production capacity of the said 2 companies makes up 70%+ of the national

figure, which caused tight supply of DK and supported ace-K price rise.

“Oligarch”

pushes up ace-K price

“In fact, seeing the suspension of ace-K related

producers, the oligarch ace-K producer, Anhui Jinhe Industrial Co., Ltd. also raised

the quotation in order to make more profits,” said Yang.

In April 22, Anhui Jinhe Industrial Co.,

Ltd. (Anhui Jinhe) raised its ace-K product by USD298.4/t to be part of the

price trend.

According to CCM’s research, the current

global demand for ace-K is about 15,000-18,000 tonnes, while the production

capacity is at about 20,000 t/a. As the largest ace-K manufacturer in the globe,

Anhui Jinhe (production capacity: 12,000 t/a) had over 7,000 tonnes delivered

in Q1-3 2016, which accounted for around 40% of the total consumption.

Now major ace-K manufacturers in the world

are Anhui Jinhe, Suzhou Hope, Beijing Vitasweet Co., Ltd. and Nutrinova (in

Germany, production capacity: 3,000 t/a). In regards to production capacity,

Anhui Jinhe is over 4 times larger than Nutrinova, showing that an “oligarch”

is appearing - Anhui Jinhe of course has a say on pricing.

However, since its competitor Suzhou Hope

has not yet withdrawn from the business, Anhui Jinhe, with an intention to

capture more shares, will not raise price hastily. Hence, the price will maintain

stability in the short run as what the price of ace-K from Aug. to Oct. showed.

Looking for more information on sweetener

market in China? Want to monitor the price trend of sweeteners? CCM Online Platform is here to help you! An infinitive database, covering the whole food and feed

industry in China, gives you real-time access to CCM’s over 15-year data and

intelligence.

To get real-time news on sweetener market

in China immediately, don’t hesitate! Get

your 7-day free trial NOW!