One more Australian infant formula

enterprise with over 100-year history has been suspended in its registration in

China. It is once again a sign of the Chinese government to strengthen

supervision on overseas imported infant formula, according to analyst CCM.

Source: Bing

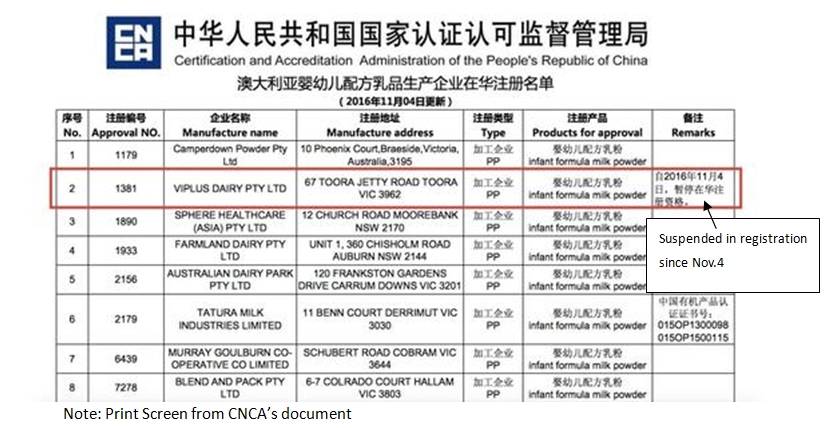

According to the latest list of

Australian infant formula enterprises registered in China released by China’s Certification

and Accreditation Administration (CNCA), the Viplus Dairy Pty Ltd. (Viplus

Dairy) is suspended for its registration in China since Nov. 4. In fact, Viplus

Dairy is already the second dairy enterprise that gets suspended in China in

this year (2016).

Based on the list, Viplus Dairy registered

for its infant formula milk powder in China. That’s to say, the suspension this

time has disqualified Viplus Dairy to sell its infant formula milk powder in

China.

Several brands under Viplus Dairy in China

Founded in 1893, Viplus Dairy is located

in South Gippsland, Australia. With over 120-year history, Viplus Dairy is one

of the earliest dairy enterprises to produce and develop infant formula milk

powder in Australia.

There are several brands under Viplus

Dairy selling in China currently, including Viplus, Anbolac, Optimum, Olibaby,

My Cravings and etc. A staff from Viplus (China)

Dairy Co. Ltd., Viplus Dairy general agent in China, disclosed that Viplus

Dairy still had no idea about the suspension on its registration in China. They

received no related notice and would verify on the suspension.

Unqualified products or unqualified dairy enterprises may lead to registration

suspension in China

In fact, earlier in June 2016, China’s

general Administration of Quality Supervision, Inspection and Quarantine

(AQSIQ) had an publication on its inspection on imported food in China from

Jan.- May 2016 and announced that the 3.8 tonnes of infant formula milk powder produced

and imported by Viplus Dairy was unqualified for its labels.

Song Liang, senior dairy analyst in

China, disclosed to CCM that, several

reasons could cause registration suspensions in China, such as unqualified

products found in inspection during customs declaration; irregular

certifications of the dairy enterprises; irregular market circulation; and food

safety problems.

Strengthen on supervision on imported dairy products

Since the melamine milk powder scandal

happened in China in 2008, China has a strong demand for imported milk powder. In

order to better manage on the imported milk powder, AQSIQ released the Notice on Strengthening Management on

Imported Infant Formula Milk Power (Notice): since May 1 2014, infant

formula milk powder from overseas dairy enterprises which don’t register in

China cannot be imported to China.

According to the Notice, overseas dairy enterprises are allowed to register in

China only after its source, production, storage, transportations and etc. pass

the inspection by AQSIQ.

“If there is no special occasion or

warning, the infant formula which are imported before the registration

suspension are still able to sell in China. However, the subsequent infant formulas

are suspended in importing. If the suspension period lasts too long, the dairy

brands will be hugely affected in sales in China,” stated Song.

In fact, Viplus Dairy is already the

second Australia dairy enterprise to be suspended in registration in China in

2016.

In Sep. 2016, Camperdown Dairy Company Pty Ltd.

(Camperdown Dairy), another Australia

dairy enterprise, was also disqualified in its registration in China.

Camperdown Dairy is also an old

dairy enterprise with 125 years history. Its import products to China include fresh

milk, fermented milk, fermented flavor milk, butter, cream and etc.

However, in Aug. 30, CNCA announced that

staphylococcus aureus and colibacillus were detected exceeded in fresh milk

produced and imported from Camperdown Dairy.

It is at the same time that CNCA

announced to entirely strengthen supervision on Australia dairy enterprises.

In order to assess and control the risks

during production and transportation of Australian fresh milk, the CNCA also

required local government departments and the 41 registered fresh milk

companies to submit related technology certificates within a certain period;

the CNCA will organise experts to conduct technological examinations to keep

the registrants up to speed on this.

This stepping up of supervision will

raise uncertainty in the Australian industry, for which China is the largest

export destination. In 2010-2015, the volume of this trade rose at a CAGR of

29.8%. In 2015/16 it reached 88,900 tonnes (= USD186.6 million OR AUD245.8

million); so far 188 dairy plants in Australia have been registered in China,

including 8 infant formula producers.

Australia or even the overseas dairy

enterprises should better prepare themselves to get their dairy products

imported to China’s market.

Looking for more information on dairy market

in China? Want to monitor what’s happening in dairy industry in China? CCM Online Platform is here to help you! An infinitive database, covering the whole food industry

in China, gives you ENTIRE access to CCM’s over 15-year data and intelligence.

To get real-time news and reports on

dairy market in China immediately, don’t hesitate! Get your 7-day

free trial NOW!