The

drop of ilmenite import can be explained with two main reasons: the decline of

the main African suppliers and increasing domestic production. This will have

inevitable effects on foreign ilmenite suppliers to China, as the volume may

continue to shrink.

Source: Baidu

Import analyzation of

ilmenite in China

For

the month September, China has imported a total amount of 194,33 tons of

ilmenite. This sum represents a month on month decrease of 32.84%. In contrast,

the price of the imported ilmenite increased averagely 17.78% MoM up to a tons

price of $119.33, according to CCM’s analysts.

On

an international view, the price of ilmenite hold a continuous increase, thanks

to the proper development of the TiO2 industry worldwide. So it is no miracle,

that the quoted prices from ilmenite suppliers in Africa, Europe, and America

remained high. Furthermore, because of the large import volume of China’s

enterprises the last month, with the ability build large inventories, the

demand for ilmenite in next times can mostly be served by this reserves.

The

import volume from the main suppliers worldwide developed quite different. In

fact, while Kenya, Mozambique, and Australia had to experience partly huge

decreases, India was able to increase their ilmenite import to China greatly.

The

exact numbers are:

Kenya: 43,409 tonnes, down

by 43.34%

MoM

Mozambique: 30,324 tonnes, down

by 59.65% MoM

Australia: 230 tonnes, down

by 99.87% MoM

India: 64,416 tonnes, up

by 51.11%

MoM

The

ilmenite manufacturers in India are about to slow down their export to China

but will keep the current price of $160/t, according to the researchers of CCM.

This demonstrates their positive look into China’s TiO2 future and also shows

the adapting to lower import demands of Chinese manufacturers currently.

The

African manufacturers of ilmenite faced huge amounts of export in the previous

months. As a result of it, some of them ran low on inventory and therefore

raised the quoted prices for ilmenite by 15% to 25%/t.

Production analyzation

of China’s domestic manufacturers

The

overall output of ilmenite from Chinese manufacturers reached 324,000 tons in

Sept. 2016. This represents a month on month increase of 5.19%, according to

CCM. The production is mainly focused on three key provinces in China:

Shandong, Guangxi, and Yunnan.

The

ilmenite market in China, in general, remains stable at the moment. Domestic

manufacturers are not increasing any production, even when facing higher demand

from the downstream TiO2 market and related to this, higher prices. It is also

considerable, that the average quotations for 46% titanium concentration ore

stay very steady with $132.87/t and show no changing trend compared to the

middle of this year.

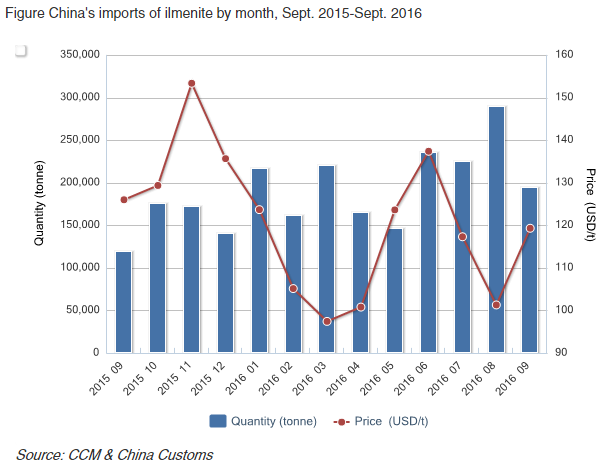

The

figure shows, that the import volume of ilmenite is increasing in average, but

shows some temporary fluctuation, with the peak in August this year. After the

peak, the volume even fell to 200,000 tons. Not only the Quantity but also the

price had some big fluctuation throughout the year. The peak of the price was

on November one year ago. In June this year there was another smaller peak. At

the moment, the price is rising again, in opposite to the Import volume.

The

increasing price of ilmenite is not only limited to China but is seen as a

phenomenon worldwide. The four biggest TiO2 manufacturing companies Huntsmen

Corp.m Kronos, Tronox and Chrystal already informed clients about higher TiO2

prices, due to the fact of more expensive raw materials like ilmenite.

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the TiO2 Market in China? Join our professional online platform today and get insights in Reports, Newsletter, And Market Data at one place.

For more trade information on TiO2 visit our experts in trade analysis to get your

insights today.

Tags: Ilmenite, TiO2