After

a long period of declining glyphosate prices in China, the current season

strengthens the confidence for increasing prices. The main factors can be found

in boosting prices of raw materials like glycine and paraformaldehyde and

increasing downstream demand. This is what traders and buyers have to expect.

Source: Pixabay

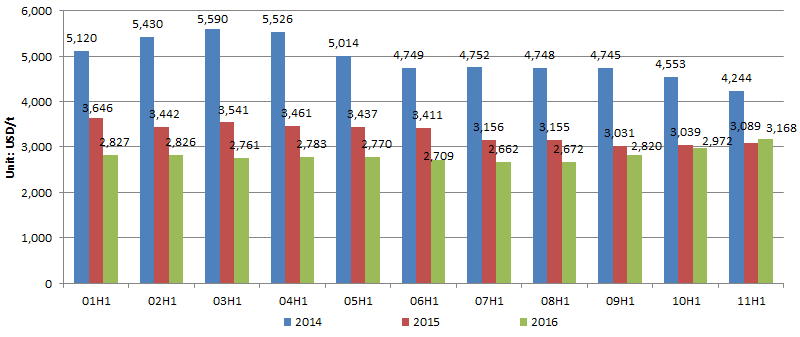

In

the middle of November, the ex-works prices of glyphosate TC and glyphosate

formulations experienced another rise compared to the last month. The price

itself is remaining on a low level compared to previous years’ development, but

the continuous price rise shows the trend back up. The prices of glyphosate

technical started to rise in August 2016 and are suspected to continue to rise

also in December, according to CCM’s analysts.

Ex-works price of glyphosate technical, January – November 2014 - 2016

Source: CCM

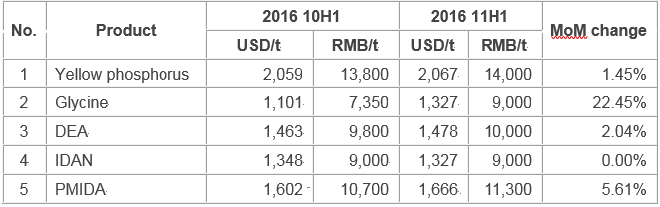

The

main reason for the recently steady growth of glyphosate price and the expected

increasing trend, is the higher price of the raw materials for glyphosates like

glycine and paraformaldehyde. Their prices are rising, due to production cuts

by governmental orders and supply difficulties in the big snowing winter of

China’s north. In fact, 70% of the glyphosate production is based on the

glycine process, which requires glycine and paraformaldehyde. Glycine price

itself experienced a month on month fall from January to September 2016. Only

recently in November, the price climbed remarkably on a 22.45% MoM basis.

The

Hebei Province in China is the most important region for glycine and

paraformaldehyde producers, with the biggest output of those, accounting for

more than half of China’s national total output. This province is also affected

by huge pollution problems. Many days endured strong pollution in different

Cities of Hebei. As a result, the Ministry of Environmental Protection ordered,

that the production of several industry sectors must be cut down. These

implementations will prospectively end on 31 December 2016. Therefore, many

producers of glycine and paraformaldehyde have reduced their operating rate,

which in turn increases the prices due to lower supply and shortage. The

leading glycine producers in China, Shijiazhuang Donhua Jiniong, and Linyi

Hongtai, already rose their prices for glycine, which represents a trend that

is going to be continued, according to CCM.

Ex-works

prices of raw materials and intermediates for glyphosate in China, October –

November 2016

Source: CCM

The

winter in China has two main effects on the glyphosate price at all. First of

all, winter is known to be the storage peak season for glyphosate, while many

manufacturers only have small quantities of inventories. This higher demand in

building a storage is driving prices upwards. Another impact is the heavy

snowfall in northern China. The snow causes difficulties in transportation,

which also leads to a shortage of raw materials and therefore a higher price of

upstream and downstream products. Paraformaldehyde is especially affected by

this issue. China’s leading suppliers of paraformaldehyde, Hebei Jin Taida and

Hebei Aerospace, both with an output of about 50,000 tons, had to cut down

production completely, due to the region’s logistics and transportation being

blocked.

Other

upstream products of glyphosate, like yellow phosphorus and methyl alcohol,

experienced increasing prices up to 30% because of increased coke prices in

November, which are traditionally caused by the heating season in China’s cold

north. The increasing coke prices, up to 200% compared to early 2016, lead to

higher prices of raw materials in China in general.

Who

will be the beneficiaries of the rising glyphosate prices? Higher prices are

favoring the vendors and industry leaders, such as Sichuan Fuhua, Hubai Taisheng,

and Yangnong Chemicals. According to the multiple factors of glyphosate price

developing, it can be expected that the price is going to rise at about 20% to

30% soon.

What’s

more, in mid of October the 2016 AgriChemEx was held in Shanghai, with all the

main Chinese pesticide manufacturers as exhibitors. But what was surprising

was, that not one of them did any price quotation at the exhibition. In the

beginning of November, several enterprises have already raised the quotations,

which led to a stable market for glyphosate by now. The increasing demand of

the northern hemisphere, that is taking place right now, will likely affect

more price rising of glyphosate TC and formulations in the near future.

About

CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the glyphosate market in China? Join our

professional online platform today and get insights in Reports, Newsletter, and

Market Data at one place. For more trade information on pesticides visit our

experts in trade analysis to get your answers today.

Tags: glyphosate, pesticide, herbicide