Rising

costs and decreased supply of raw materials keep the price of Titanium Dioxide

rising in China. According to CCM, the overall business of TiO2 will be stable

the next months till Spring Festival.

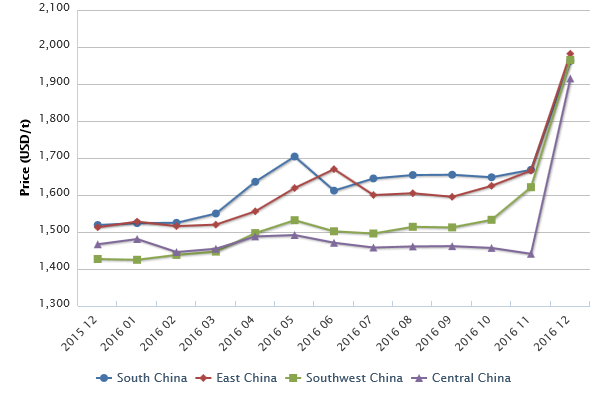

Ex-works price of

anatase TiO2 in China by region, mid-Dec. 2015 to mid-Dec. 2016

Source: CCM

29.38%

increase year on year and 32.05% year on year rise are the numbers of rutile

TiO2 and anatase TiO2 in the middle of December 2016. This increase leads to an

average price of USD2,249/t for rutile TiO2 and USD1,956/t for anatase TiO2.

While rutile TiO2 has been increasing almost steadily since the beginning of

the year, anatase TiO2 prices remained compared to that relatively stable,

until November 2016. Now in December this product has made a huge jump in price

increase with a percentage of 22.34% compared to the previous month.

CCM

states, that this development is mainly due to production deduction of titanium

ore and TiO2 manufacturers, who are operating in China’s Panxi area. The

reduction is part of the governmental plan to increase environmental protection

and the quality of air and water again.

However,

even if the reduction of production will continue longer, it will is going to

be balanced out by sinking domestic demand for TiO2, decreased the export value

and a lower activity in the downstream industry of TiO2. So, CCM is expecting a

stable development of the TiO2 price in the middle-term.

Development of the

upstream market

Looking

at the raw materials for the TiO2 production, most of them show an increasing

price trend as well. The biggest rise can be seen for titanium slag (74-76%).

Here the price was increased more than USD50/t in Sichuan Province, with less

increase in Yunnan and Hebei province. According to CCM, the trend can be

explained by price rises of titanium ore.

Titanium

slag (90%) did not perform this well. While the price was also increasing in

December 2016 in Sichuan Province, the price trend in other provinces like

Yunnan Province has seen even slight losses.

Furthermore,

Ilmenite could state a very steady price increase during the year 2016, with a

higher price increase in mid-year and now at the end of 2016, the price rose

faster again as well. This is explained by CCM again with the production

suspension in Panxi region in China.

More about the

production reduction

The

production limitation in the Panxi region in China takes place because it was

revealed in early December, that several enterprises in this area had

discharged clandestinely some polluted water with the effect of a huge

environmental pollution. As a result, 28 companies had to suspend their

production, of which 8 are TiO2 and its upstream products manufacturers,

according to CCM.

The

outcome of this measurement is affecting the amount of supply, which is going

to be less. It will also benefit huge companies with their own supply chain like

Sichuan Lomon because they are less affected by increasing raw material prices.

There

are more production reductions in China in several industries recently, due to

the focus of China’s government on higher environmental protection. According

to CCM, this will improve the supply-demand situation of TiO2 in China in

general and may lead to a steady price rise.

About CCM

CCM is the leading market intelligence provider

for China’s agriculture, chemicals, food & ingredients and life science

markets.

Do

you want to find out more about the TiO2 Market in China? Join our professional online platform today and

get insights in Reports, Newsletter, And Market Data at one place. For more

trade information on TiO2 visit our experts in trade analysis to get your

insights today.

Tag: TiO2