China’s

sterilant herbicide market is mostly represented by the four pesticides

glyphosate, glufosinate-ammonium, diquat, and paraquat. According to CCM, all

of the four herbicides have experienced a price boom at the end of 2016, which

is likely to continue in 2017 as well.

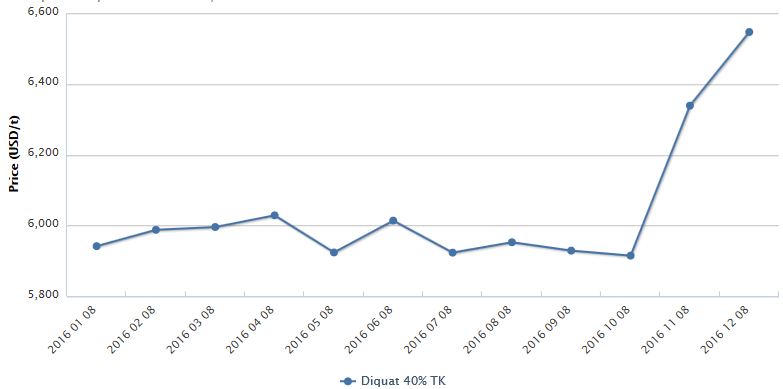

Ex-works

price of diquat 40% TK in China, Jan.-Dec. 2016

Source:

CCM

2016

was a difficult year for Chinese manufacturers of sterilant herbicides. They

had to endure a depression of the market and low prices for quite a while. In

the end of 2016 however, the main four sterilant herbicides in China all have

shown a significant price rise, due to increasing demand and shorter supply in

general.

The

strengthened demand mostly occurred from the stockpiling of pesticides for the

winter. On the one hand, many pesticide formulation manufacturers have

increased their purchase of pesticide technical for that reason, on the other

hand, increased quotes from overseas suppliers have several enterprises turned

their head to Chinese suppliers and ordered there, which increased the market

demand as well.

The

tight supply of pesticides still results of the governmental actions regarding

air pollution in China’s most important pesticide producing provinces. These

provinces are Beijing, Hebei, Shanxi, Shandong, Henan, and Sichuan. The

governmental actions mostly affect production limitation or stop of

manufacturers in the high pollution industry, like the pesticide industry.

CCM

believes, that these measurements are not done yet. Enterprises are very likely

to bear even higher burdens in the new future, due to the environmental

protection efforts of the Chinese government. This will continue to keep up the

short supply of pesticides in China and therefore the price high.

Another

factor for the short supply of pesticides is the heavy snowfall in northern China,

leading to transportation problems of raw materials and supply shortage.

The price development

According

to CCM, the glyphosate 95% technical price in China hit is the lowest point in

July 2016, able to rise again in a higher degree every month until December,

where it hit the value of USD3,491.87/t. The overall rise since the low value

of July 2016 represents 38.63%. That is one of the largest increases in the

last two years, says CCM.

The

ex-works price of glufosinate ammonium 95% technical in China experienced a

large drop in the first half of the year 2016, down to USD16,496.21/t in July.

The price stayed long for a couple of months, until it showed a large increase

in December again, up to USD21,824.21/t. This rise was an overall boom of

32.30%.

From

January till October 2016, the ex-works price of diquat 40% TK in China hovered

on a low level around USD6,000/t. However, in the last two month of this year,

the price skyrocket finally to a value of USD6,547.26/t in December. That is an

increase of more than USD500/t since October.

The

fourth sterilant herbicide CCM analysed is paraquat 42% TK. This pesticide went

through a permanent price decrease from February to July 2016, stayed on a low

level until November until the price rebound again in December 2016. The price

hit the mark of USD1,600/t in that month.

What’s

more, CCM believes, that the uptrend price of pesticides will continue in 2017

as well. Firstly, the price for grain is likely to continue rising in 2017,

which will automatically increase the demand for pesticides as well. Secondly,

the governmental forced production cut off many enterprises may even become

stricter, which will balance out the present overcapacity and leads to a higher

pesticide trend in general.

Also,

the total number of Chinese pesticide manufacturers is shrinking continuously.

More costs in environmental protection and the lack of funds have led to a

shutdown of several small and mid-size enterprises in China, increasing the short

supply even more.

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the pesticide market in China? Join our professional online platform today

and get insights in Reports, Newsletter, and Market Data at one place. For more

trade information on pesticides visit our experts in trade

analysis to get your answers today.