CCM has analysed the market

trend of glyphosate in China in the year 2016 with the focus on the price

development and the supply situation throughout the year. Furthermore, the

market trend of glyphosate in 2017 is analysed, backed up by the

historical data as well as future events and developments, that will have a

decisive impact on the glyphosate market.

Source: Pixabay

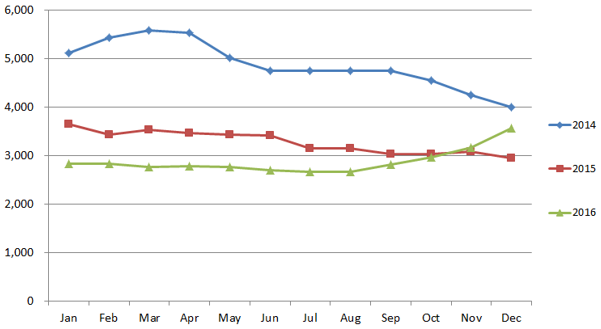

2016

China’s glyphosate technical price in

2016 was marked with a continuously decrease in the first two-third of the year

and the following rebounding off the price in the last third. However, the

long-term falling in most months of the year has led to the lowest average

price of glyphosate technical in 2016 compared to the last 3 years. The average

unit price has been USD2,878/t, which is a decrease of over USD400 to 2015 and

even almost USD2,000 compared to 2014, according to CCM.

2016 experienced a fluctuation

in glyphosate technical price of about USD976/t. The lowest point was in August

with a price of USD2,662/t and the peak was reached at the end of the year after

a continuing rose in four months till December, stating a price of USD3,563/t.

CCM has also discovered, that the typical seasonal fluctuation of the

glyphosate technical price in China is getting less during the last years,

which is an indicator for a policy-driven market development instead of a

demand-driven one.

The price fall in the beginning

and middle of 2016 can be explained by a very competitive behavior of China’s

pesticides manufacturers, trying to get some market share in the situation of

high supply of glyphosate technical. The prices were lowered to get some piece

of the cake. Additionally, raw materials of glyphosate technical, namely bulk

pesticides and glycine, showed dramatically low prices, partly even record lows

in their prices, which causes the price fall of downstream products like

glyphosate technical as well.

On the other hand, the price

rebound in the last four months of 2016 is the result of the tighter supply of

glyphosate technical and some of its upstream materials. The tight supply

appeared because the Chinese government has strengthened their efforts in

environmental protection and forced highly pollution companies to lower or even

cut their production completely. Some companies also used the depressed market

situation to achieve some acquisitions, hoping for higher profits after it.

The supply situation, according

to CCM, can be summarized in a production capacity, output and operating rate

of about 1 million tonnes in 2016.

Monthly

market price of glyphosate TC in China, 2014-2016 in USD/t

Source:

CCM

2017

CCM predicts, that that the price of

glyphosate technical will fluctuate between a level of USD3,309-USD4,748/t in

China in 2017. On the one hand, the environmental inspections of China’s

government will go on in 2017, keeping the price of raw materials and

glyphosate technical itself high in the new year. The production limitations

and environment protection systems implementations are not limited to the

pesticides industry, but to many high-polluting industries in China. Hence, the

overseas market is likely to accept overall higher prices from China, which can

keep the price high in general.

The news of OPEC members, to limit the

oil production in terms of raising the price of oil again, will also have its

effect on the pesticide production worldwide. Higher oil prices cause higher

production costs of pesticides, including glyphosate technical. So, an

international price rise of glyphosate technical can be the result, in which

case the Chinese producers are very likely to follow the price rise with their

own products.

According to CCM, the output of

glyphosate in China is not going to be expanded or limited in 2017. Glyphosate

is part of the restricted list of the NDRC, which will not allow new

participants to join the market. The environmental inspections will continue,

which also leads to a stable output of glyphosate technical with now rise in

the short term. Finally, bad news about glyphosate still causes a decent demand

for this pesticide worldwide. Although, the domestic demand is likely to

increase in 2017, looking at the ban of paraquat AS in China and the resulting

search for substitutes, which can be found in glyphosate technical.

What’s more, glyphosate producers have

to be aware of other herbicides-tolerant systems, that can be a substitute for

glyphosate in 2017. Dicamba is one of the main competitive products to

glyphosate, mainly used in the USA for an example.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets.

Do you want to find

out more about the glyphosate market in China? Join our professional online

platform today and get insights in Reports, Newsletter, and Market Data at one

place. For more trade information on pesticides visit our experts in trade

analysis to get your answers today.