China’s

largest dairy manufacturer Huishan Dairy is facing massive problems currently,

after an unexpected fall of shares by around 85% recently. By now, most of the

directors have left the company, leaving a hole in the strategy and management

for the company to escape the crisis.

Source: Pixabay

It

was March 24, when the share price of Huishan Dairy plumped down by 85% in

rarely one and a half hours. Chairman Yang Kai has lost about three-quarters of

his wealth and is yet to find for a public statement.

In

the shadow of the huge fall is a high debt situation of the company, which is

responsible for the cash shortage and worries of creditors. Some of the creditors,

like wealth management firms and peer-to-peer platforms, have suggested to

freeze the assets, which has been carried out by a Shanghai court and even

consider law suit.

In

addition to the financial crisis, the company is also facing a director exodus.

Huishan Dairy’s board of directors is losing its members ever since. According

to market intelligence firm CCM, six directors have already left their

positions. The reasons are given target mostly focusing more on other jobs and

personal relations.

Yang

Kai’s wife and supervisor over money transactions as well as relationship

management with creditors, Ge Kun, has vanished on March 21. Leaving the

company without any contact. Huishan Dairy even has contacted the police in

case of missing person. Her only note left states she needed more time off due

to high stress at work. Hence, currently only three members are left on the

board dealing with the business of the company.

However,

Huishan Dairy is still one of the major employers and taxpayer in China’s

economy-weak province Liaoning. This situation grant the enterprise to expect

help from the local government and not be wiped out in a financial crisis.

However, Liaoning has caught attention earlier to fake some economic numbers in

order to hide the recession it falls to as the only province in China.

A

member of China’s large bank ICBC, one of the main creditors of Huishan Dairy

estimates, that the company is facing over USD5.8 billion debt. Hence, large

banks need to extend the loans for at least another year, while smaller money

lenders are under enormous pressure. The incident has definitely scared of

possible investors.

It

is a huge question for stakeholders of the company if the Chinese government is

willing to help the weakened enterprise. According to South China Morning Post,

the government has announced to let over-debt companies fall without support,

as part of the new supply-side reform.

The

company already held a meeting with governmental executives and creditor banks

at the end of March. During that meeting, the Liaoning province representatives

agreed to a plan in solving Huishan Dairy’s debt problems, with the bankers

showing trust in the more than 60 years old company.

What’s

more, the profit of Huishan Dairy was shrinking during the last years, due to

the rapidly falling milk prices in China. However, the company kept investing

on a high level, covering the growing debt-to-equity ratio.

According

to market intelligence firm CCM, China’s dairy industry is facing some real

challenges nowadays. In fact, there is a sluggish consumption in the domestic

market, still high costs for the raw materials, an increasing reliance on dairy

imports, an unbalanced product mix in the market, and overall low reputation of

the quality. Looking back at the year 2016, showing a sluggish market trend of

the dairy industry in China, due to increasing imports of products with low

prices

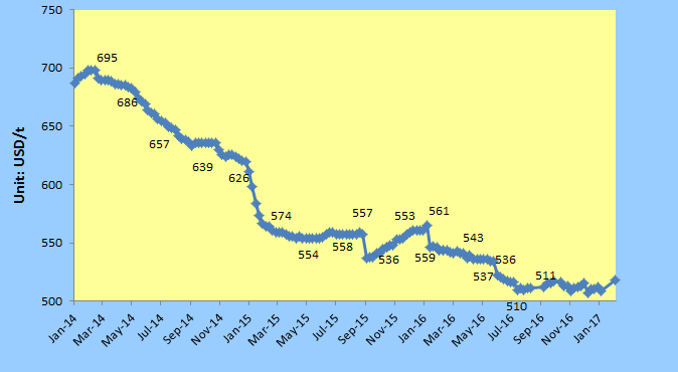

Purchase

price of raw milk, Jan2014-Feb2017

Source:

Ministry of Agriculture

The

production of dairy products from 2009 to 2015 went up by 44%, while the

industry profit in the same period increased by 210%. In the first three

quarters of 2016, the output increased again by 7.5% year on year. The number

of dairy manufacturers went down in the last years, resulting in a

concentrating of sales by the top 20 producers in 54% of the national sales.

About CCM

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the dairy market in China? Try our Newsletters

and Industrial Reports or join our professional online platform today and get

insights in Reports, Newsletter, and Market Data at one place.

For

more trade information of dairy products, including Import and Export analysis

as well as Manufacturer to Buyer Tracking, contact our experts in trade

analysis to get your answers today.