The insecticides

industry in China is in a huge transformation these days. Influenced by

increasing production costs, environmental inspections, and rising resistance,

the market is facing serious difficulties, while new opportunities arise. (Originally

published in the May/June issue of Speciality Chemicals).

Source: Pixabay

Since

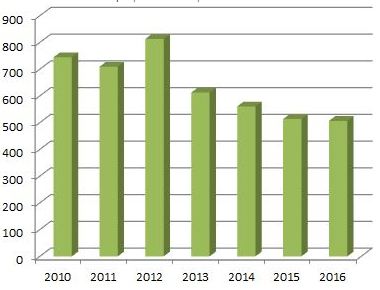

the peak in 2012, China’s output of insecticides is falling constantly. Hence,

the year 2016 has witnessed another fall. However, the fall in 2016 was the

smallest one in four years, which may indicate an end for the declining

industry trend.

The

output of the pesticides industry in China, on the other hand, was increasing

1% compared to 2016, due to the uprising trend of herbicides and fungicides. As

a fact, the insecticides industry is losing share of the total pesticides

amount in China continuously. Accounting for 31.79% of all pesticides in 2009,

the share declined ongoing to 13.42% in 2017.

Figure 1:China's insecticide output, 2010-2016, 1,000 tonnes

Source: National Bureau

of Statistics of the People’s Republic of China

What’s

more, the production of insecticides is highly concentrated in some areas in

China. As a result, the top three regions are responsible for 72.08% of the

total output. The leading manufacturing region is Jiangsu with a share of

43.77%. The other two main regions for insecticide output are Shandong and

Hubei.

The

past decade has seen the largest structural optimisation in insecticides,

compared with other pesticides. During the 12th Five-year Plan period

(2010-2015), the state attached great importance to optimisation of insecticide

product mix as well as development of new fungicides and herbicides to further

meet demand from crop production.

One

of the biggest problems of pesticides usage in China is the growing problem of

pesticide residue and food safety, resulting of monotonous use in large

amounts. China is using about 1.5 to 2.5 times more pesticides than developed

countries, which raise these concerning issues. What’s more, the damage of

inefficient and overused pesticides is causing losses worth around USD300

billion.

However,

currently the efficiency and quality of insecticides in China is on the rise.

One of the main regions with insecticides manufacturers is Hubei Province in

China. The city Yichang in this province has announced several accomplishments

in the year 2016. These comprise out of insecticides usage on crops, tea and

vegetables reduced by 2%, utilization rate was 39%, green coverage rate of 30%,

and the integrated control and prevention rate was 40%.

Rice Asiatic borers

show high resistance

The

rice Asiatic borer is one of the insects that is showing a surging resistance

to common insecticides in China. Hence, experts predict a heavy strike for 2017

and even the beginning of 2018. According to market intelligence firm CCM, this

trend reveals high opportunities for manufacturers of insecticides in China.

According

to the Nanjing Agriculture University, during the past years, the rice Asiatic

borer has developed resistance against a growing number of insecticides. Monitoring

stations in important provinces started to detect populations highly resistant

to methamidophos, monosultap and triazophos in 1990-2000. What's worse, the

pests developed high resistance to monosultap, triazophos and fipronil later in

2000-2012, and to chlorantraniliprole as well as abamectin after 2017.

The

reasons for the heavy occurrence in 2017 and 2018 can be found in several

factors, including an expanded planting area of hybrid rice, continual rice

planting, excessive fertilising, and improper insecticide application.

However,

the occurring danger is offering huge opportunities for insecticides

manufacturer and trader. Besides innovative products and technology, companies may

also help farmers to use pesticides scientifically and make timely business

adjustments based on field research.

Environmental policies

After

the occurrence of heavy pollution in many Chinese cities 2016, the government

has increased measurements against heavy polluting manufacturers. New standards

were arisen, which many producer failed to meet, leading to production

suspension or even complete cut off.

One

new law with stricter regulations is the Atmospheric

Pollution Prevention and Control Law of the People's Republic of China. The

amended version is considered as the most stringent law for air pollution and

control ever. Specifically, it requires the government to increase financial

supports for air pollution and control and to include it in the national

economic and social development planning.

Furthermore,

great revisions of the Water Pollution

Prevention and Control Law were made compared with the 2008 version. The

new law includes strengthened joint pollution control of rivers that flow

through multiple provinces, including their catchment areas and tributaries as

well as perfected water pollution supervision and control system by connecting

pollutant discharge licensing with total discharge control and discharge

standards.

In

addition to that, manufacturers in China can expect large-scale environmental

inspections by the local authorities. These inspections already begun in the

end of 2016 and will be continued in 2017. These inspections make sure of the

implementation of environmental rectifications.

Affected

the strict regulations, most insecticide manufactures maintained low operating

rates. Reduced output, coupled with increased raw material prices and

environmental costs, pushed up insecticides prices.

Tags: Insecticides, Rice Asiatic borer