Foreign

companies are dominating many dairy product markets in China, due to the higher

quality and cheaper production costs than of domestic manufacturers. However,

the segment of yoghurt is mostly covered by Chinese firms, enjoying high-profit

margins and booming demand while facing less competition from international

players.

China’s

dairy market is still heavily depending on imports, even the country is

investing a lot to strengthen the domestic dairy industry and regain the trust

of consumers for Chinese made dairy products. After all, in 2016, China was

only able to cover the domestic demand for dairy products by 75%.

According

to the Ministry of Agriculture in China, the demand for dairy products in China

is growing faster than the domestic production and supply, which will decrease

the self-sufficient rate down by 5% in the next 3 years and another 5% till

2025.

After

all, China’s dairy market is booming, reaching up to USD55 billion in 2016,

which places the country in the second rank behind the USA. This year, total

sales of dairy products are USD64 billion in the United States.

Premium

milk products like yoghurt have seen the biggest growth of dairy products as

consumers start to choose higher quality products.

Yogurt revenue growth

to surpass milk products

However,

even China used to be a large dairy product importer, in the domestic market

for yoghurt Chinese manufacturers are ahead of their Western counterparts. Only

three domestic dairy players in the market have reached a share of 70% of the

national yoghurt market. This demonstrates the growing competitiveness of

Chinese dairy firms in domestic markets. Looking at the dairy market in

general, the three enterprises just reach a market share of 50%.

According

to the Financial Times, the revenues of fermented dairy products are going to

surpass the ones of milk products for the first time in China. While Chinese

milk sales will just grow around 4% in 2017, the growth of yoghurt is expected

to grow more than 18%. Total sales of yoghurt in China has risen by 108.6

percent from 2013 to 2017, whereas milk sales grew by just 18 percent in the

same period, the report said.

The

three main players are Yili, Mengniu, and Bright Dairy. According to market

intelligence firm CCM, all of these companies have launched new yoghurt

products in 2017 to expand their share in the market. Many of these new

products belong to the premium segment, enlarging the choice for consumers who

are increasingly getting more aware of quality and healthcare products.

Selling

yoghurt is very popular for manufacturers in China since the profit margins

exceed the ones of plain milk by almost double. Currently, the profit margins

are at 40%. The high margins enable a good profitably of this business,

accounting for a big share of the total revenue for the dairy manufacturers.

The

yoghurt market has been growing robustly both in terms of volume and value.

Even the Chinese players are facing increasing competitive pressure from

overseas players, regional players, start-up companies, as well as players in

other food and beverage markets are still dominating the game.

Notably,

this dairy product has also been a lifesaver for several dairy producers in

China, as they had been struggling to cope with the slowdown in demand and the

decline in prices, due to oversupply.

China’s yoghurt imports

surges

In

general, China’s dairy import has increased by about 20% year on year in 2016,

based on volume. However, the import value only grew by 12% in the last year.

In

2015, China imported 10,274 tonnes of yoghurt and buttermilk, while in 2016 it

was already 20.988 tonnes. Of this amount, 15,237 tonnes were yoghurt alone.

This represents an increase of 104.3%. Looking at the import value, it grew by

almost 52% from 2015 to 2016, with USD27.8 million in 2015 to USD42.2 in 2016.

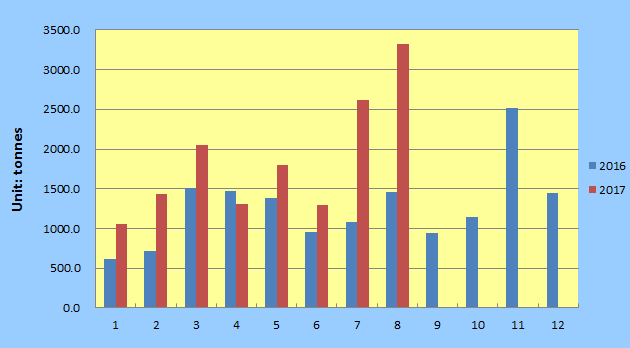

China’s

Yogurt Imports, January 2016 – August 2017

Source:

CCM

Notably,

the import share of yoghurt and buttermilk in all dairy imports was only 0.5%

in 2015 but grew to 0.9% in 2016. The still relatively small amount is caused

by the strong market share of domestic players and the resulting less need for

imports. For comparison, the share of whole milk powder in 2016 was 18.4% and

of milk and cream products 27.8%. These are the products which Chinese still

prefer the foreign brands due to the better reputation and quality.

Foreign companies are

missing their share

Overseas

enterprises have yet to get a reasonable market share in China’s highly

profitable and booming yoghurt market. Since the demand is growing faster than

the supply, manufacturers and traders could focus on the Chinese market in the

near future and launch their own premium yoghurt products to participate in the

competition for fulfilling the needs of a middle-class with growing income and

hunger for healthy yoghurt products.

About CCM

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the dairy market in China? Try our Newsletters and Industrial Reports or join our professional online platform today and get

insights in Reports, Newsletter, and Market Data at one place.

For

more trade information of dairy products, including Import and Export analysis

as well as Manufacturer to Buyer Tracking, contact our experts in trade

analysis to get your answers today.