Summary:

The European

Commission has recently embarked on an anti-dumping investigation into Chinese

exports of valine, involving five Chinese companies. This move follows a

preliminary ruling on anti-dumping duties for Chinese lysine exports. Despite

the tariffs imposed, China's lysine market position remains robust due to high

EU demand and limited global supply alternatives. The ongoing trade disputes

highlight the complexities of international trade in amino acids and the

potential for Chinese enterprises to accelerate their overseas expansion plans.

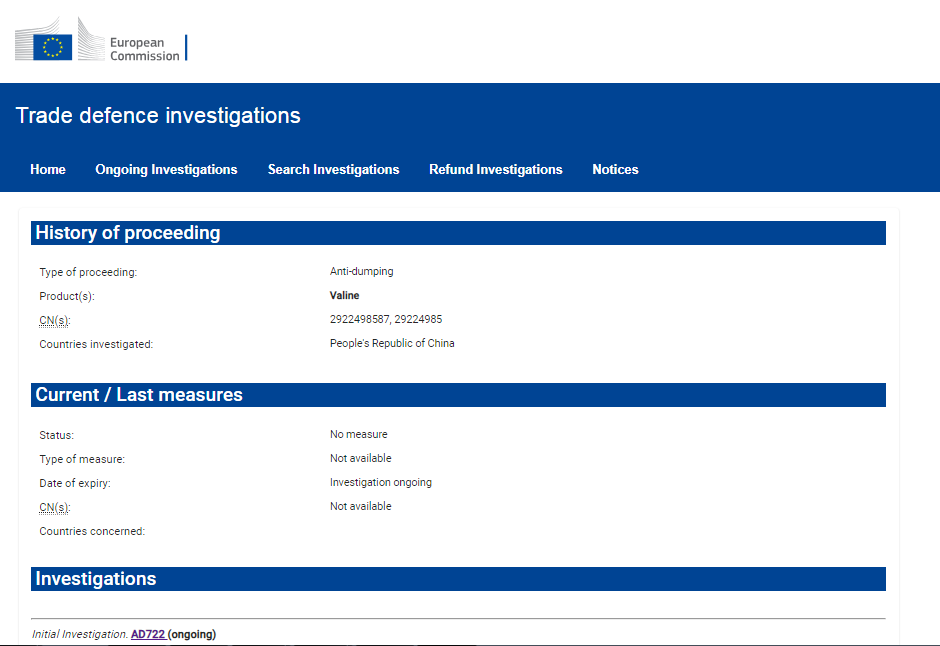

P1 Anti-dumping Investigation on Valine by the European Commission

According to CCM market sources, French company Metax has filed

an anti-dumping complaint against five Chinese enterprises, namely Huaheng,

Yipin, Fufeng, CJ China, and Meihua, with the European Commission regarding

valine imports. The period covered by this dumping investigation is set from

October 1, 2023, to September 30, 2024, while the injury investigation period

spans from January 1, 2021, until the end of the dumping investigation period.

A preliminary ruling in this case is expected within seven months, with a maximum

duration of eight months.

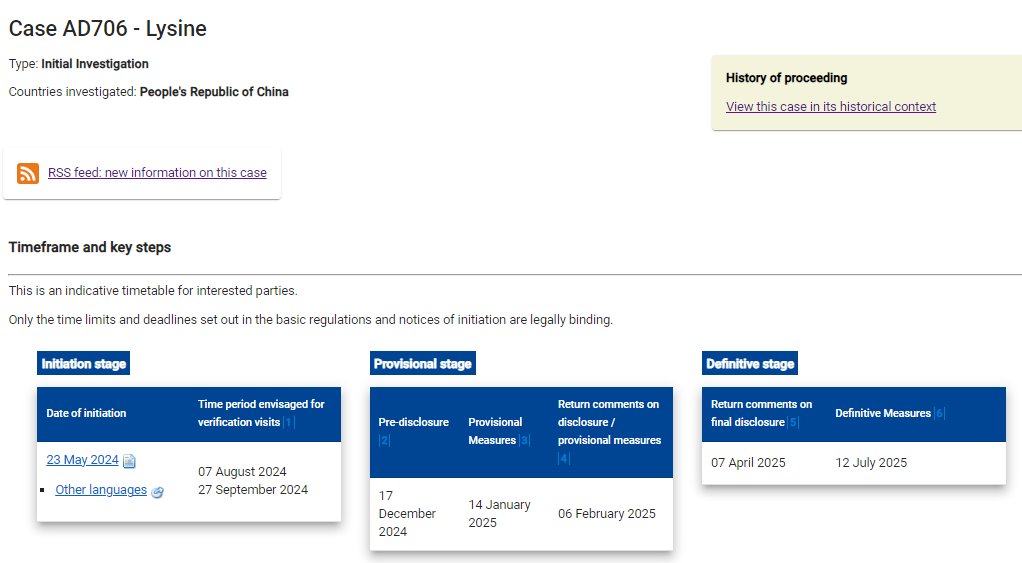

P2 Anti-dumping Investigation on Lysine by the European Commission

Prior to this, the European Commission initiated an anti-dumping

investigation into lysine originating in China and recently published its

preliminary ruling on anti-dumping duties for Chinese lysine exports, with

tariffs ranging from 58.3% to 84.8%. Although this ruling has had a short-term

impact on Chinese lysine exports, the overall impact may be limited due to the

continued strong demand for lysine in the EU.

According to CCM Market Insights, China exported approximately

1.8 million tonnes of lysine globally in 2023, with nearly 490,000 tonnes

destined for the EU, accounting for roughly 27% of the country's total export

volume. Given the EU's estimated lysine demand of around 500,000 tonnes in the

same year, coupled with METEX's full-capacity production of 80,000 tonnes, the

region still confronts a significant supply gap exceeding 400,000 tonnes. As

China stands as a pivotal global supplier of lysine, with combined capacities

from other nations barely topping 500,000 tonnes, the EU is likely to continue

relying heavily on Chinese imports to meet its requirements.

The imposition of these anti-dumping duties could potentially

cascade down to EU livestock farmers and trigger a surge in export activities

in the near term. Data from the General Administration of Customs reveals that

from January to October 2024, China's export volume of 98% lysine increased by

17%, indicating the resilience of China's market position despite production

constraints.

Longer-term perspectives reveal that such trade frictions might

catalyze Chinese enterprises to accelerate their overseas expansion strategies.

Notably, leading amino acid producers such as Meihua Biological Technology and

Fufeng Group have already embarked on aggressive internationalization paths.

Meihua Biological, for instance, has announced the acquisition of food and

pharmaceutical amino acid businesses to bolster its overseas forays, while

Fufeng Group intends to establish production facilities in the United States

and other regions.

Collectively, with the heightened global focus on food security

and steady demand growth from Asia, Africa, and Latin America, the amino acid

market remains optimistic in its outlook. However, caution must be exercised

regarding the uncertainties surrounding the final anti-dumping outcome,

fluctuations in overseas demand, and the progress of enterprises' overseas

footprints, as these factors may influence future lysine prices and sales

volumes.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & feed and life science markets. Founded in 2001, CCM offers a range of content solutions, from price and trade analysis to industry newsletters and customized market research reports. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.