What you need to know

about China's food ingredients market before visiting the Exhibition FIC 2017

in Shanghai on March 26-28.

The

Food Ingredients China 2017 (FIC 2017), held from March 24-26 in Shanghai, is

an international brand show in the food industry with a huge influence on the

development of the food ingredients and additives market in China. Highlights

of this exhibition are usually product and technology launch events, as well as

academic forums and lectures. This year, the exhibition will cover 23 segments

of food additives, 35 categories of food ingredients, food processing aids,

novel food, and food machinery.

The

FIC 2017 is expecting 1400 exhibitors from worldwide, while about 90% of them

will be manufacturers and exporters. The highlight for this year is set on

natural & healthy food as well as the machinery zone. Meet China's biggest

players in the food ingredients industry to stay ahead in the market in China.

The

event displays commodities like antioxidants, bulking agents, egg products,

natural and organic food and additives, oils and fats, food processing

equipment, food testing equipment, vegetable protein, frozen and chilled food,

packaging machinery and materials, and honey as well as honey extracts,

Some

of China's manufacturers, which you can visit at the exhibition for

critical relationship building, are:

Shijiazhuang

Dongfeng Chemicals Co., Ltd.

Shijiazhuang

Lida Chemical Co., Ltd.

Inner

Mongolia Jianlong Biochemical Co., Ltd.

The

FIC is the main platform to build sustainable relationships with China's

players in the food ingredients industry, just like vitamins, amino acids,

starch, sweeteners and more. Hence, knowing about the market industry in China

can be the critical factor in making the best out of visiting the exhibition.

CCM helps you to prepare for the FIC 2017 with the analysis of China's most

important food ingredients and additives segments.

Vitamins

China's

vitamins have witnessed great surges in the first three-quarters of 2016. The

biggest winners have been especially vitamin A, vitamin E, vitamin B5, and

vitamin B2.

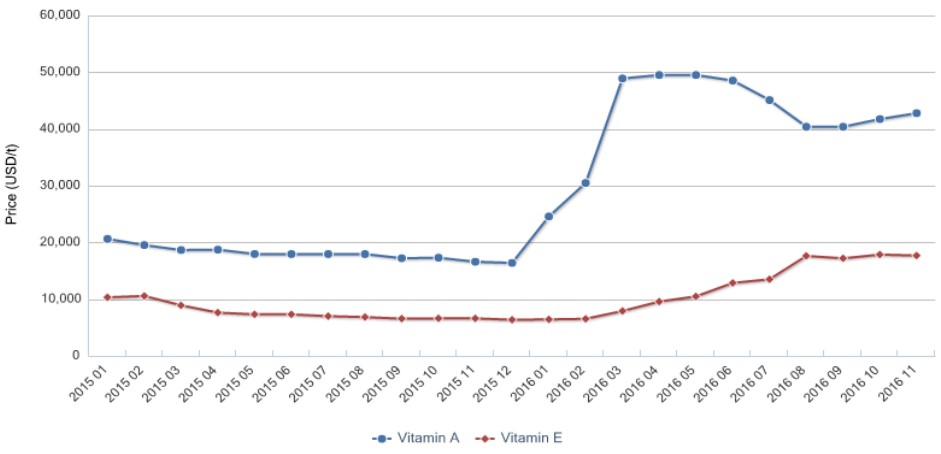

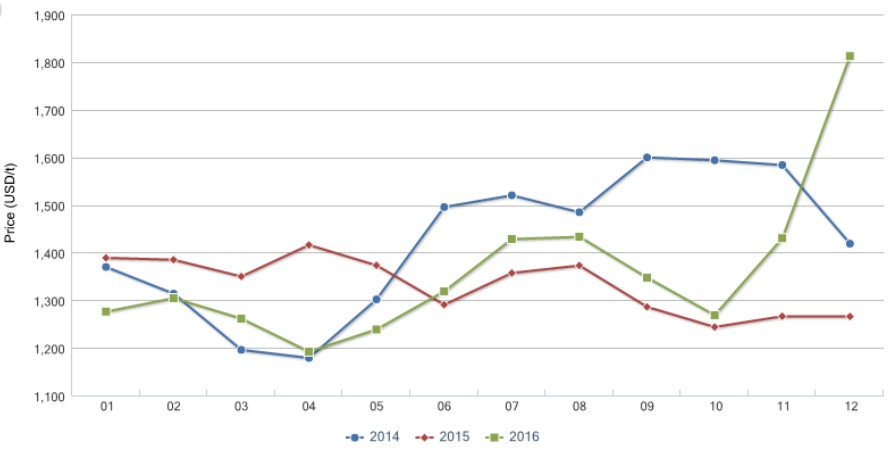

Vitamin E & A

According

to CCM's price monitoring, the biggest price hike in terms of percentage rise

has been seen for vitamin E. This vitamin, as in 50% feed grade powder, was

able to surge over 173% from January to August 2016. The second rank can be

given to vitamin A, as it has shown a price boost of over 100% from January to

April 2016. However, after the peak in April, the price for feed grade vitamin

A fell again until it remained stable about slightly over USD40,000/t. China's

manufacturers enjoyed huge profits during the price hikes, as the financial

performance of producers like Zhejiang NHU and Zhejiang Medicine shows.

Monthly market prices

of feed grade vitamin A (500,000 IU/g) and 50% feed grade vitamin E, Jan.

2015-Nov. 2016

Source: CCM

The

reasons for this massive increase can be found in the tight supply situation as

well as rising demand for vitamin A globally. The short supply was caused by a

massive production reduction of one of the world leading vitamins manufacturers.

In December, one of the main factories was shut down for maintenance, which

lasted for three months and showed the significant shorter supply of vitamin A

in the market. As a result, many companies turned their eyes to Chinese

suppliers, which could raise their prices accordingly.

Furthermore,

in January 2016, the domestic demand for vitamin A was increasing once more.

This demand was due to the upcoming Chinese New Year festival, which is

traditionally a period of high demand for food ingredients in general. The spring

festival also had the effect, that the country-wide holiday led to a reduction

of Chinese producers, increasing the short supply in that period even more.

Looking

at the next quarter, Q2, the short supply of vitamin A was still going on. This

time, it was due to the shortage of an important upstream product of vitamin A,

namely citral. Hence, the prices stayed on a very high level with even a

further slight increase. During Q3 the global demand for vitamin A decreased

again, which resulted in a moderate fall of prices as well.

Then,

on October 17, 2016, a big news was brought from Germany. In one of the plants

of the biggest worldwide supplier of the raw material citral, BASF, an

explosion occurred, leading to a shorter supply of this raw material and hence

to higher prices for vitamin A again. The rising prices were also supported by

the high demand of purchasers, who were worried about the following vitamin A

supply and purchased lots of vitamin for their stockpile.

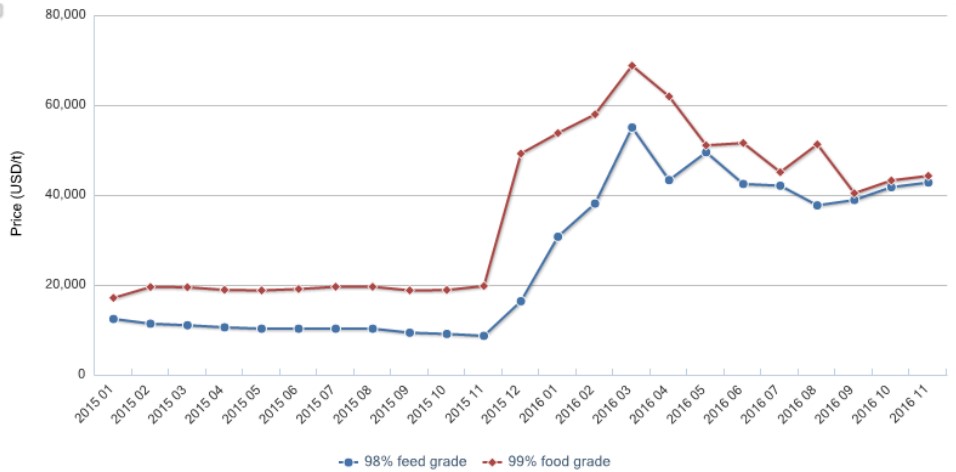

Vitamin B5

Vitamin

B5 price showed an immense surge after a very stable trend in 2015. The peak

for both, 98% feed grade and 99% food grade did reach the peak in March 2016.

They then fell down in average until September 2016, just to start a price

growth again at the end of the year.

Monthly market prices

of vitamin B5 (98% feed grade and 99% food grade) in China, Jan. 2015-Nov. 2016

Source: CCM

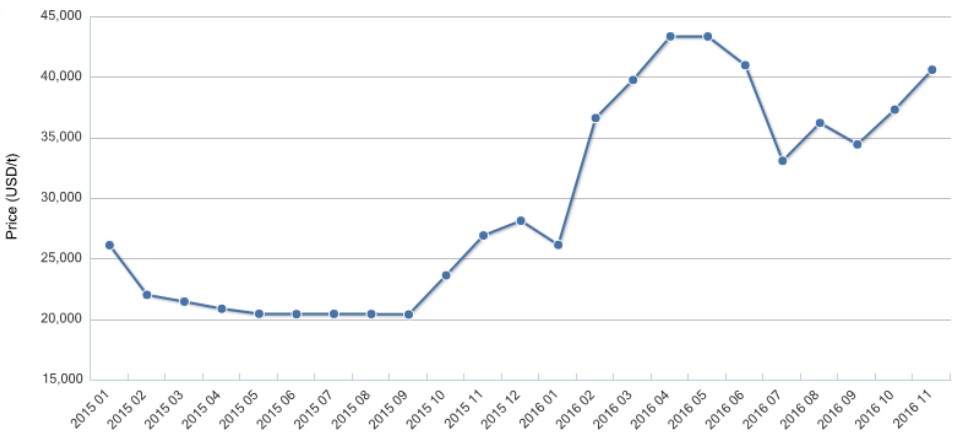

Vitamin B2

The

vitamin B2 price trend went similar to the vitamins mentioned. After the

hovering over a relatively low price in 2015, this vitamin experienced A boost

already at the end of 2015 with continuing until April of 2016. The price then

fell down to a certain extent, until the price went rising again at the end of

the year 2016. The big winner of the price surge is China's largest vitamin B2

producer, namely Guangji Pharmaceutical, who also heads the global vitamin B2

market in output and sales.

The monthly market

price of 80% feed grade vitamin B2 in China, Jan. 2015 -Nov. 2016

Source: CCM

Vitamin C

Nevertheless,

other vitamins, like vitamin C, also showed a rising price trend at the end of

2016. The price of vitamin C witnessed another growth in November 2016 by

16.67% YoY. Market intelligence firm CCM gives two reasons for the price

rebound of vitamin C in China, Q4 2017.

The

first reason is the reduced market supply of vitamin C in China. The shrunken

supply was caused by decreasing inventories of vitamin C together with

production limitations of Chinese producers due to maintenance and

environmental protection measurements.

The

second reason for the price hike can be found in the announcement of one of

China's biggest vitamin C producers DSM Aland Nutraceuticals. The raised prices

quotations are supposed to reflect increasing cost pressure and the need of

investments for its facility.

Environmental

Protection Law

The

new Environmental Protection Tax Law was revealed on December 25, 2016, and is

going to come into effect in the beginning of 2018. It will mainly replace the

current pollution discharge fee by the Chinese government with a new

environmental protection tax.

The

new law is the first one of its kind in China, aiming to get successful actions

against the growing pollution in the country and protect the environment from

heavy pollution discharges of several industries. The key factor to convince

enterprises establishing environmental friendly productions and discharge

systems lays in a tax reduction for significant pollution reducing actions.

To

be more precise, the tax allows a tax reduction of 25%, if the pollution

discharge, mainly wastewater and air pollution, is 30% lower than the national

or provincial standard for this pollution concentration. If the company is even

able to keep its pollution 50% lower than the standard concentration, they can

apply for a 50% tax reduction at all. So, the system clearly benefits

environmental protection solutions of enterprises with lowering their costs.

Besides air and water pollution, also noise pollution will be charged by taxes.

The

vitamins industry is one of the heavily polluting industries, beneath

chemicals, cement, and pharmaceutical industry. As a result, the environmental

protection tax law will without any doubt have a massive effect on the

manufacturers in China and their efforts for a cleaner production.

Now

with the implementation of the new law, China's manufacturers are facing

stricter regulations, that are threatening the regular business they are doing.

In the long term, the law may force traditional producers with a lack of

innovation and technological upgrades to shut down the business.

Amino Acids

Methionine

China's

and worldwide leading manufacturers of methionine, and those who want to become

one are increasing efforts in the production of methionine. These plans to

penetrate into the market may lead to an overcapacity in the near future.

Zhejiang NHU, Bluestar Disseo, and Chongqing Sanxia, just to name three

companies, are expanding their production by building new facilities or

purchasing existing methionine producing enterprises.

Also,

the world biggest methionine producer, Evonik, which is currently responsible

for about 35% of global sales of methionine, has recently started to build a

new plant in Singapore with an estimated production capability of 150,000

tonnes a year by 2019.

The

increasing efforts are based on the optimistic outlook for the Asian methionine

market, especially the one in China, as China is the leading methionine

consumer with a demand of over 225,000 tonnes in 2016, according to CCM. The

domestic need, especially for the animal feed industry, is going to rise about

10% to 15% in the next years, experts predict. Hence, the competition in this

promising market is attracting many enterprises in China and overseas.

Besides

Evonik, a few other enterprises, namely Adisseo, Novus International, and

Sumitomo, are accounting for 90% of global sales. This shows the high

monopolistic attitude of this market, due to the complicated production

processes. However, China's manufacturers are starting to catch their piece of

the cake by entering the market. Examples for new players in China are Ningxia

Unispledour, Zhejiang NHU, and Sichuan Hebang.

If

the plans of the new players become reality, China would face a methionine

production of 600,000 tonnes by 2020, facing the total demand of 447,000

tonnes. Hence, a huge overcapacity is likely to be the result of the

strengthened competition in China.

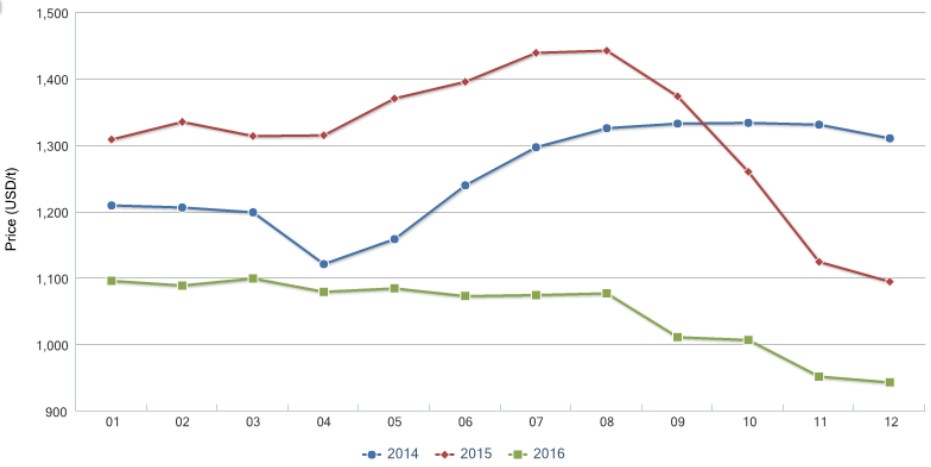

Lysine

China's

lysine market, on the other hand, has been facing a huge fluctuation throughout

the year 2016. According to CCM's price monitoring, the overall downtrend of

price in 2016 went on in the beginning of 2016. It then rebounded and were able

to rise till the third quarter of 2016. Looking at the year on year change in

2016, China's lysine price witnessed an overall rise of USD26.32/t.

The monthly market

price of 98.5% lysine in China, Jan. 2014-Dec. 2016

Source: CCM

The

main two reasons for the large fluctuation can be found in the changes of corn

price in China and the intensified transportation pressure.

The

price of lysine is strongly bound to the price development of corn in China,

seen it as the main raw material. So, when the corn price fell in the first

months of 2016, due to huge oversupply, the lysine price was reduced as well.

The rebound in April was then the reaction of tighter supply in the domestic

market before the launch of the national auction for temporarily stored corn.

The

rebound of lysine in November is the result of the winter start in China,

leading to a prioritised transportation of coal for heating instead of food

additives like lysine. Another factor is the new traffic regulations,

implemented in September, which require a lower transportation capacity. These

effects led to a reduced supply and hence surging prices.

Looking

at the exports of lysine ester and salt from China in 2016, a boost of 26.62%,

compared to 2015, can be seen. According to CCM, this trend can be explained by

the low export price of lysine, combined with the continuing depreciated RMB.

Overseas manufacturers have been preferred the cheap food additive from, China

instead of the local ones.

What's

more, China's manufacturers witnessed great net profit performances in 2016,

due to the lower production costs. The future looks promising as well, due to

the high lysine price, increasing exports, and the still falling costs of corn

in China. Hence, domestic manufacturers are very likely to continue the great

performance ongoing.

Sweeteners

Many

factors are affecting the sugar and sweetener market in China recently.

Environmental health policies are limiting the production of sweeteners in

China. Also, a Pollutant Discharge Licensing System is being implemented, which

will without any doubt influence the sweeteners industry in China ones more.

The financial performance of Chinese sugar manufacturers varied greatly in Q3,

resulting in increasing production costs, rising sugar price, and decreasing

sales volume. In 2015 and 16 the planting area of sugarcane in China decreased,

leading to a shortage of sugar, which is the main reason for the current high

prices.

Sugar

During

the last year, the planting area of sugarcane did decrease. This causes a

higher purchase cost for the sugar producers, due to shorter supply.

Additionally, some heavy rain during that time also reduced the quality of

sugarcane, increasing the cost of sugar manufacturing ones more.

The

increasing costs even exceeded the increasing prices of sugar, which actually

led to losses for many manufacturers, according to CCM's analysis. Downstream

users searched for substitutes for the more expensive sugar in China, also led

to a declined sales volume.

CCM

furthermore predicts that the sugar price will continue rising in China. The

reasons are a depreciating RMB, limited growth of the sugar output in 2016 and

17 as well as expected decreased imports. However, the price rise will be

limited, due to the launch of the national sugar reserves, the new production

of sugar in the coming period and more substitutes for sugar.

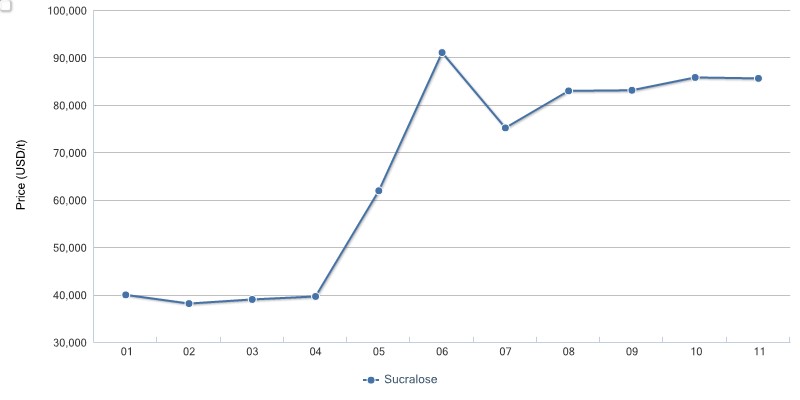

Sucralose

Sucralose

experienced an increase of over 100% in 2016, mostly caused by short supply

because of environmental protection and the resulting price rise. It is

expected, that manufacturers grow their production to balance the short supply,

which will shrink prices again.

Ex-works price of sucralose

in China, Jan.-Nov. 2016

Source: CCM

The

case of JK Sucralose's production suspension demonstrates the short supply

situation of sucralose in China 2016. It even led to a lack of inventory for

many companies.

The

company had to reduce production because of the order from the Environmental

Protection Bureau of Jiangsu Province, stating, that the wastewater treatment

of the facility didn't meet standards. JK Sucralose is the largest sucralose

manufacturer in China and the second biggest in the world, with a capacity of

2,000 t/a, so the suspension of his production had a huge impact on the supply

situation in China. The reduction affected about 40% of production, which makes

the producers still larger than competitor's production.

According

to CCM, the ex-works price of sucralose was USD86,912/t in November 2016.

That's just a 1.28% rise MoM, but more than 100% compared to January 2016.

The

fastest growth took place in June with 56.25% increase alone.

Since

sucralose is made of sugar, the increasing sugar price is affecting the

sucralose price immensely. According to sucralose manufacturers, a further

price rise of sucralose is very likely, if the sugar price keeps rising as

well.

Starch, MSG, and DDGS

Corn Starch

China's

corn starch industry was finally on the rise again in 2016, due to four

game-changing factors that benefited the development.

First

of all, the falling corn prices in China have reduced the production costs of

corn starch to a great extent. Second, the consumption of corn starch in

several industries in China has witnessed a growth of between 27.1% up to 56%.

Industries with a large increasing demand have been the paper making industry

as well as the food industry. But also, modified starch and beer has become

more demanded in China.

As

a measurement to ease the heavy oversupply of corn in China, several provinces

have implemented subsidies for corn processing, which was mainly happening in

the starch and alcohol industry. Hence, companies in these areas have increased

their efforts to enlarge the production. Finally, a rising export volume also

has strengthened the corn starch industry in China, facing a year on year

increase of exports by 97% in January to November 2016.

Potato Starch

In China, potato starch is the main processed outcome of potatoes. China is

furthermore the largest potato producer and consumer. Hence, a large effort is

set on the enhancement of the potato starch industry. However, the industry is

facing some challenges, namely a current overcapacity, which can be solved by a

low output and the irrational consumption while facing the "staple food'

strategy.

The

growing output of potato starch capacity in China has reached 2.3 million

tonnes a year. However, this supply is only facing a demand of about 600,000

tonnes. Hence, currently, China's manufacturers have reduced the production

dramatically, also due to a fierce market competition, high transportation

costs, and the pressure from environmental protection measurements. As a

result, the total output in 2016 reached just about 350,000 tonnes, which eases

the overcapacity accordingly.

The

biggest buyer of potato starch in China consists of the food industry,

accounting for almost 80% of total share. For comparison, high developed

countries use this commodity mainly in the pharmaceuticals, textiles, paper

making, and petroleum industry.

Currently,

potato starch is used for desserts and as a thickening agent in Chinese food

and hospitality industry. However, despite its excellent thickening effects, high

prices have always slowed down a large popularity of potato starch.

In

Jan. 2015, China put forward the strategy of "promoting potato as staple

food", aiming to increase the consumption of potato products to more than

30% in 2020. According to the 13th Five-year Plan for the Potato Processing

Industry (2016-2020), China's output of potato vermicelli shall reach 400,000

to 600,000 tonnes in 2020, up 17%-71% from the target set during the previous

12 Five-year Plan period (2010-2015).

MSG

Despite

other food ingredients in China, MSG has reached its historically lowest price

in December 2016, with a value of USD942.6/t, after an already long period of a

continuously falling trend.

The monthly ex-works

price of MSG in China, Jan. 2014-Dec. 2016

Source: CCM

Reasons

for the bad performance of MSG in China is the dumping corn price. As corn is

the major raw material for MSG, the price fell alongside with the decreasing

price of corn. Furthermore, the production capacity of MSG was growing

constantly, leaving to a situation of oversupply and hence to falling prices

again. The oversupply is still serious looking at an annual output of

2.7million tonnes with a demand of only 1.4 million tonnes and an export volume

by 420,000 tonnes.

The

MOC finalised the antidumping and anti-subsidy duties on imported DDGS from the

US. CCM believes that this move will further reduce Chinese DDGS import volume,

strengthen demand for corn and soybean meal, and stimulate the supply of

alcohol.

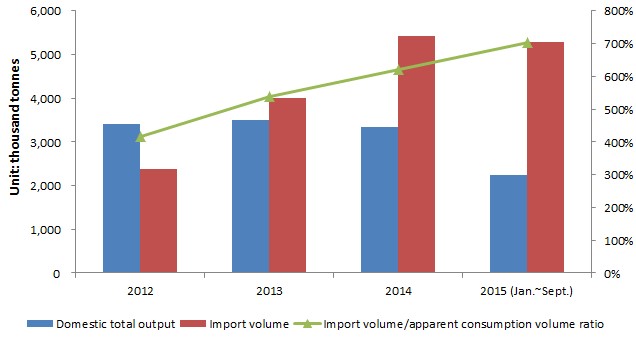

DDGS

On

January 11, 2017, the Ministry of Commerce of the People's Republic of China

(MOC) stated that the USA was ruled to have dumped DDGS into China, which has

caused substantial damage to the Chinese DDGS industry. As a result, China

decided to respectively impose 42.2%-53.7% and 11.2%-12.0% of anti-dumping and

anti-subsidy duties on DDGS from the USA for 5 years, starting on January 12,

2017.

As

the largest DDGS importer in the world, China mainly imported DDGS from the

USA. American DDGS enjoys a lower price as well as higher quality than Chinese

DDGS. Coupled with the surging domestic corn price in the past few years, the

import volume of DDGS have risen significantly. According to China Customs,

import volume reached 6.82 million tonnes in 2015, up 26.1% YoY. In addition, the

proportion of apparent consumption volume of imported DDGS climbed 70.2% in

Jan.-Sept. 2015 from 41.6% in 2012.

Output, import volume

and apparent consumption volume of DDGS in China, 2012-2015 (Jan.-Sept.)

Source: MOC

What's

more, DDGS is a by-product of corn alcohol, which can be used as a raw material

in feed to provide energy and protein. Therefore, DDGS is a good

substitute for corn and soybean meal. In 2016, China's corn price slumped and

dragged down the domestic DDGS price, resulting in sharply falling import

volume of DDGS. According to China Customs, the country imported about 3

million tonnes of DDGS in Jan.-Nov. 2016, which represents a down 46.8% YoY.